Uptober in reverse: how investors can now predict cryptocurrency market movements

October is traditionally a good month for cryptocurrencies, it even has a nickname - Uptober. But in 2025, it has turned into one of the worst months for cryptocurrencies in the last decade. Rustam Botashev, Partner and Investment Director of Blockreign Fund, wrote in his column for Oninvest how to understand what will happen to the cryptocurrency market next.

Why cryptocurrencies are falling

Bitcoin began to fall at the end of the first week of October and for a month and a half fell by more than 30% from its maximum value of $126.2 thousand. Ether's performance is even worse. During the same period, it lost almost 40% of its price. In total, since October 6, the crypto market has "shrunk" by an impressive $1.1 trillion.

The reason for the fall in the value of cryptoassets lies outside the blockchain industry. It is quite possible that this is a correction of the classic market. And bitcoin as a more volatile and risky asset simply acted as a leading indicator.

Bitcoin reached its all-time high on October 6. And on October 10, U.S. President Donald Trump threatened to impose additional 100 percent duties on Chinese goods and tighten controls on U.S. software exports. This threat came in response to China's new restrictions on exports of its rare earth metals, critical to the U.S. technology and defense sectors.

This, of course, has huge implications for the US technology sector. So it's no surprise that high-tech stocks have fallen. But what does this have to do with bitcoin? None. However, bitcoin and etherium fell more than the Nasdaq on October 10 - by 7% and 12%, respectively, versus a 3.5% drop in the index. A record number of positions totaling $19.37 billion were liquidated in the crypto market overnight.

Since then, crypto-assets, led by bitcoin, have continued to fall. The most popular cryptocurrency in the world first broke through the psychological mark of $100 thousand, and on November 18 and 19, its price fell below $90 thousand.

To be fair, the price of cryptocurrencies was further affected by bad events in the blockchain industry. We are talking about the $128 million hack of one of the oldest DeFi protocols Balancer on November 3. Balancer runs on the Ethereum blockchain. On that day, ether was falling at a momentum of 9%.

If on November 20 in the afternoon bitcoin was trading at a price above $91 thousand, and it seemed that its fall had stopped, then by the evening it began to fall again. On Friday, October 21, it momentarily cost less than $86 thousand. And now market participants are trying to "catch the signals" and understand what will happen next.

The dynamics from the point of view of technical analysis is worrisome. One of the bearish signals indicating a possible downtrend is the so-called "death cross". This is when the 50-day moving average of the price has fallen below the 200-day moving average. Bitcoin has been in this exact cross since November 16. It is far from certain that the bitcoin price drop will continue or panic selling will begin. In 2024 and 2025 bitcoin has already been in the same "crosses". And in both cases, after that, it entered the phase of active growth.

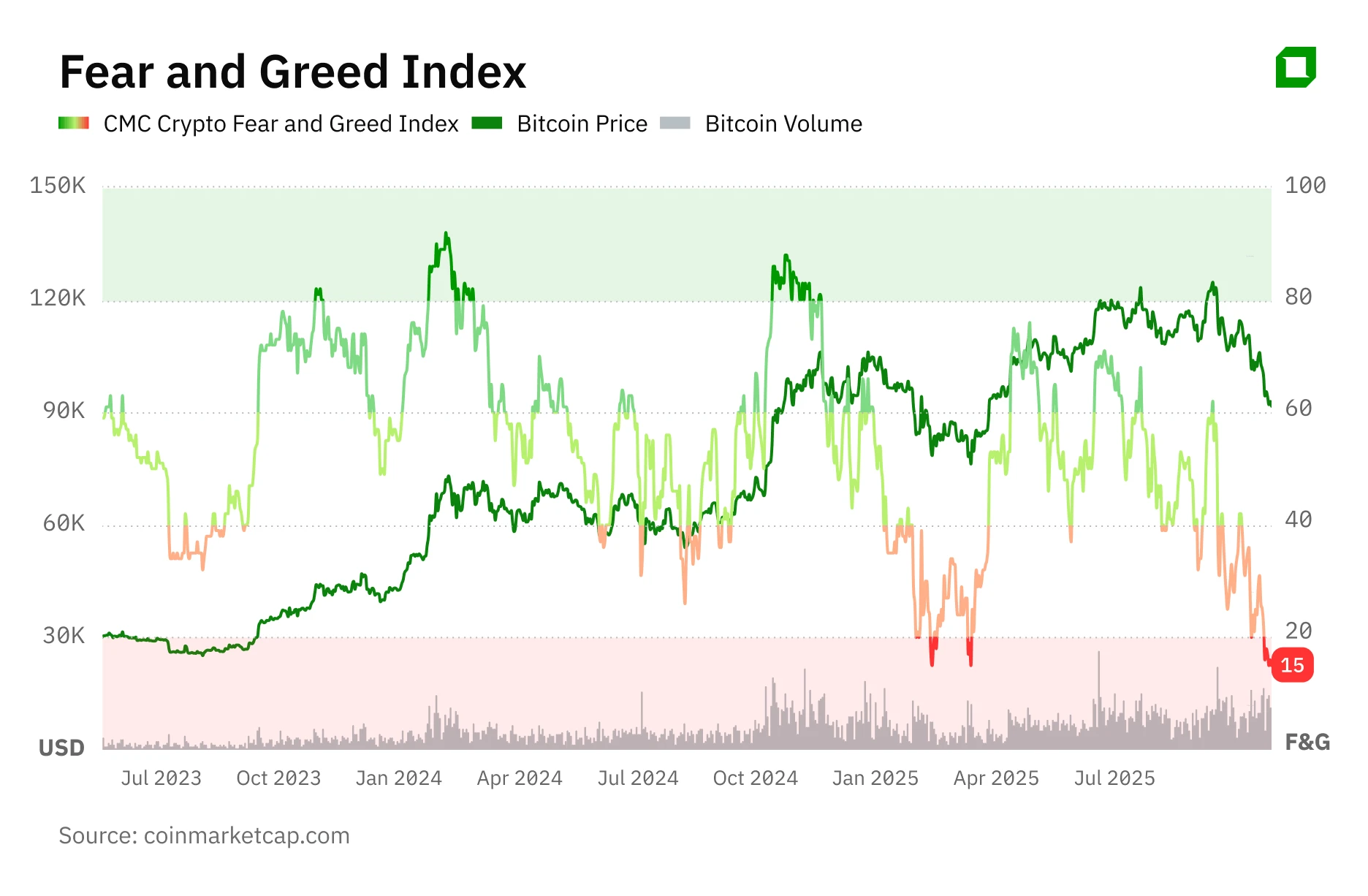

We may see a rebound and growth now as well. This may be indicated by a signal such as theFear and GreedIndex, which on November 20 was at a low of 15 (as in this chart), which means extreme fear. And by the morning of November 21, it had already fallen to a low of 11. In other words, most are now afraid to even hold bitcoin and are selling. This is often a good time to buy.

Role model: what to watch out for for crypto investors

However, such reasoning and forecasts might make more sense if the composition of bitcoin investors had not changed significantly recently. And with the launch of ETFs on cryptocurrencies, it has started to change.

Investors who follow the development of the blockchain industry and understand the difference between various projects and their tokens are now being supplanted by classical investors. For them, the entire crypto market is "one big bitcoin" and one of many assets (and not the biggest) in a portfolio.

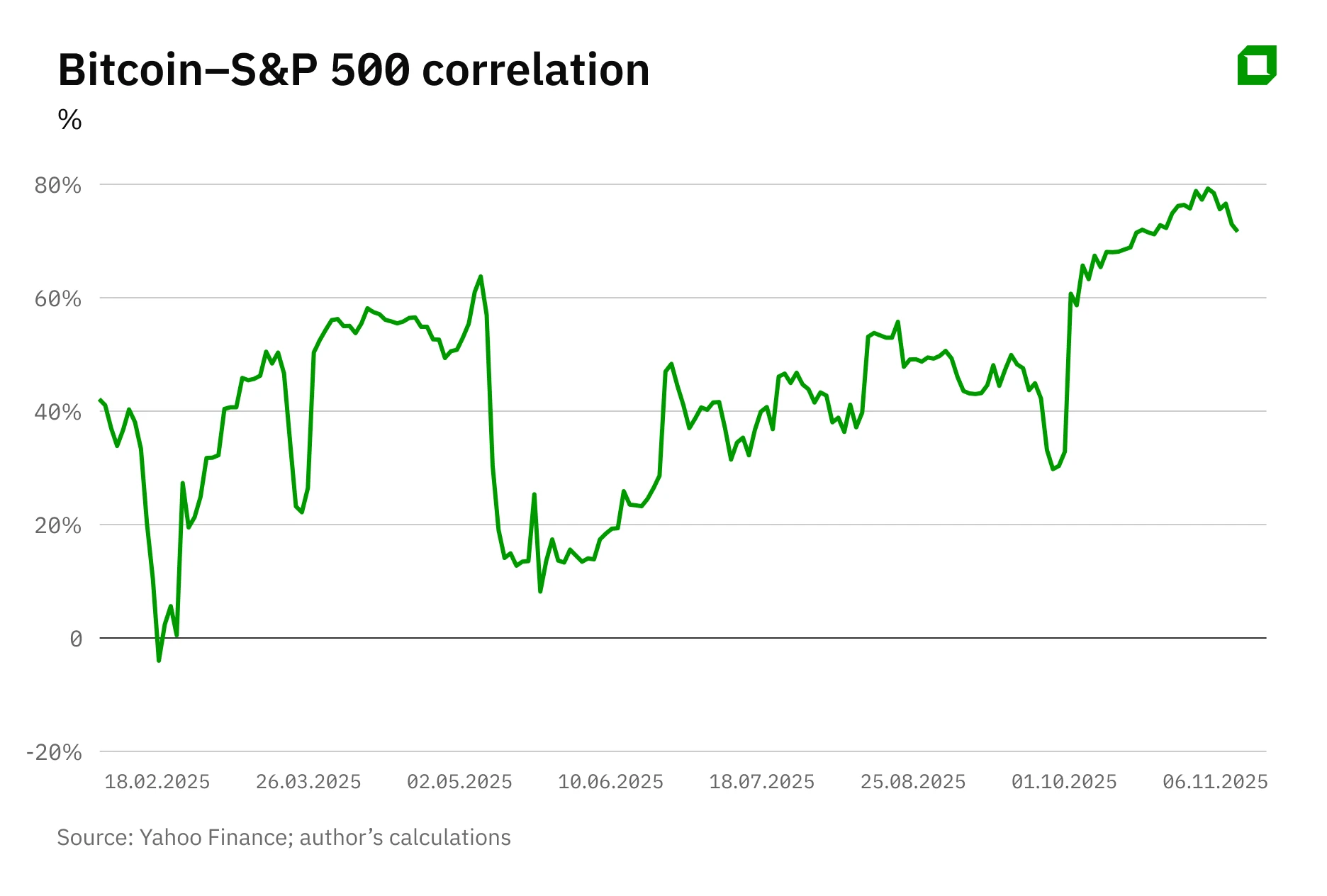

Trading pictures are changing accordingly. The price of cryptoassets is increasingly influenced not by something specific to the blockchain industry, but by what affects stock prices. This is especially noticeable during periods of market declines.

Right now, the 30-day correlation between the bitcoin price and the S&P 500 is 71%. In 2023 and 2024, it did not rise above 50%. In other words, their movements are becoming more and more similar. With the technology sector, the correlation is even higher. Bitcoin is now behaving like a kind of leveraged Nasdaq.

In other words, predicting the price movement of bitcoin, and with it many other crypto-assets, is basically now predicting the price of tech stocks. Since the beginning of the year, the Nasdaq is up more than 14%, and the S&P 500, in which tech giants are now heavily weighted, is up 11.2%. The stock market is clearly overheated and in need of a correction. Especially the technology sector.

A possible correction has already started - with bitcoin.

The first thing investors withdraw from is risky assets, which are cryptocurrencies. From November 3 to 19, investors withdrew $2.9 billion from the bitcoin-ETF. For comparison, from November 3 to 18, Nvidia lost more than 10% of its capitalization.

Had the company's November 19 results been worse or at least in line with market expectations, the decline would have continued. But the results were better than expected, and Nvidia's shares jumped in the after-market. Bitcoin fell to $88.6 thousand on November 19, but also began to grow actively by the evening, when the published results exceeded expectations.

But the optimism of investors did not last long. By the evening of November 20, the U.S. market went down again, Nvidia closed in the negative - its quotes fell by 3.15%. Bitcoin fell again.

Now it is unlikely that bitcoin will grow without the growth of the stock market. This means that investors in this cryptocurrency should look at the expectations in the "classic" market.

There are a huge number of very professional analysts, both technical and fundamental, trying to predict stock market movements.

If stocks rise, bitcoin will most likely rise, and at a faster rate. The opposite is also true. I continue to argue that bitcoin is not a protective asset, it has not become and will not become "digital gold" in the near future. Thus, diversification of stock portfolios with bitcoin is ineffective.

There is a small chance that bitcoin will continue to fall even as stocks rise. This could happen, for example, if classical investors start to exit bitcoin by moving into stocks due to deteriorating technical analysis indicators. If this happens, it can be used as a point to enter the market.

This article was AI-translated and verified by a human editor