Volozh's AI company Nebius has another bull. He expects the stock to rise 54%

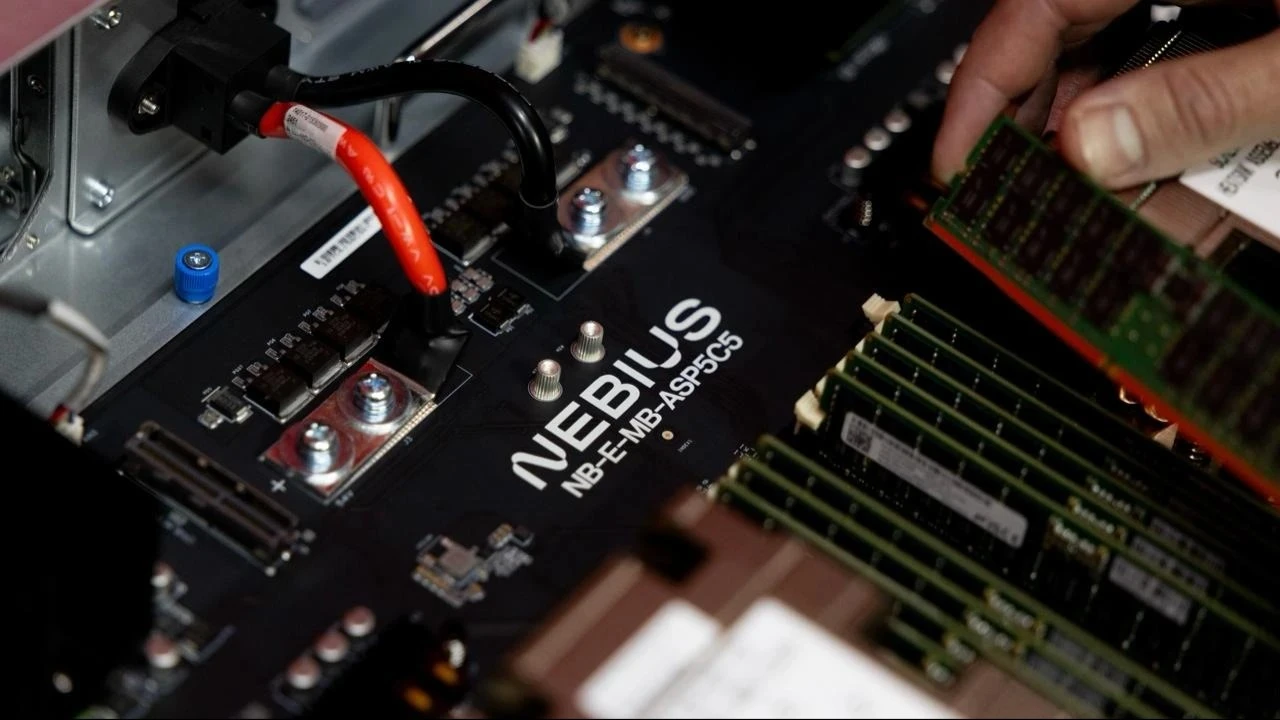

An analyst initiated coverage on shares of AI company Nebius Volozha with a "buy" recommendation / Photo: Nebius Group

American investment company Compass Point has started covering shares of cloud provider Nebius Group, which is headed by Yandex co-founder Arkady Volozh. Compass analysts gave it a "buy" recommendation and a target price of $150, CNBC writes, suggesting a potential upside of 54% from the last close.

Details

Nebius' strength is its work in the most scarce segment of technology infrastructure, says Compass Point analyst Michael Donovan. This is about the capacity of data centers with secured power supply, which are especially in demand now. In addition, the company knows how to effectively utilize its investments in graphics processing units (GPUs), turning them into ready-to-work computing clusters as customer demand grows.

"The company operates on a full technology stack model - from cloud software to specialized hardware solutions and infrastructure facilities - that delivers predictable performance, high capacity utilization and reliability," Donovan wrote.

Nebius shares jumped 4.4% on February 18. Over the past year, the company's market value has increased by 126%, and since the beginning of 2026, it has already added 22%.

Which drivers the analyst sees

Nebius' infrastructure is built on the latest Nvidia platforms and high-speed networking solutions, enabling it to perform large-scale model training and inference, i.e., running models that have already been trained, explains the Compass Point analyst. In addition, the company is integrating cybersecurity tools and capacity reservation systems, lowering operational barriers for businesses that plan to deploy AI-based solutions, Donovan notes.

In his estimation, the immediate catalysts for Nebius will be major partnerships. "Agreements with hyperscalers - Microsoft and Meta - provide demand predictability, while rapid revenue growth and increasing ARR (annual recurring revenue) form the basis for accelerating the business in the short term," the analyst said.

He expects Nebius to commission the AI infrastructure in a timely manner, maintaining high utilization rates as it scales.

Donovan also pointed to Nebius software as an additional growth driver and praised the AI Cloud product, designed for large-scale model training and computational workloads, and the Token Factory platform, focused on industrial inferencing and model pre-training tasks.

What others are saying

In early February, Freedom analysts initiated coverage of Nebius and advised buying it, also citing its partnership with Nvidia and contracts with tech giants Microsoft and Meta. They also cited the company's mature management and strong team among its strengths.

A little earlier, in mid-January, analysts at Morgan Stanley took a neutral stance on shares of Nebius. The company has a total of two such ratings, MarketWatch shows .

Over the past month the "bearish" rating appeared as well. At that, the majority of analysts recommend to buy Nebius securities: 10 out of 13 analysts. And the average target price of $150 implies growth by 57%.

This article was AI-translated and verified by a human editor