Volozha's Nebius will buy an AI agent search service. How is this good for investors?

Nebius will release its quarterly earnings in two days' time

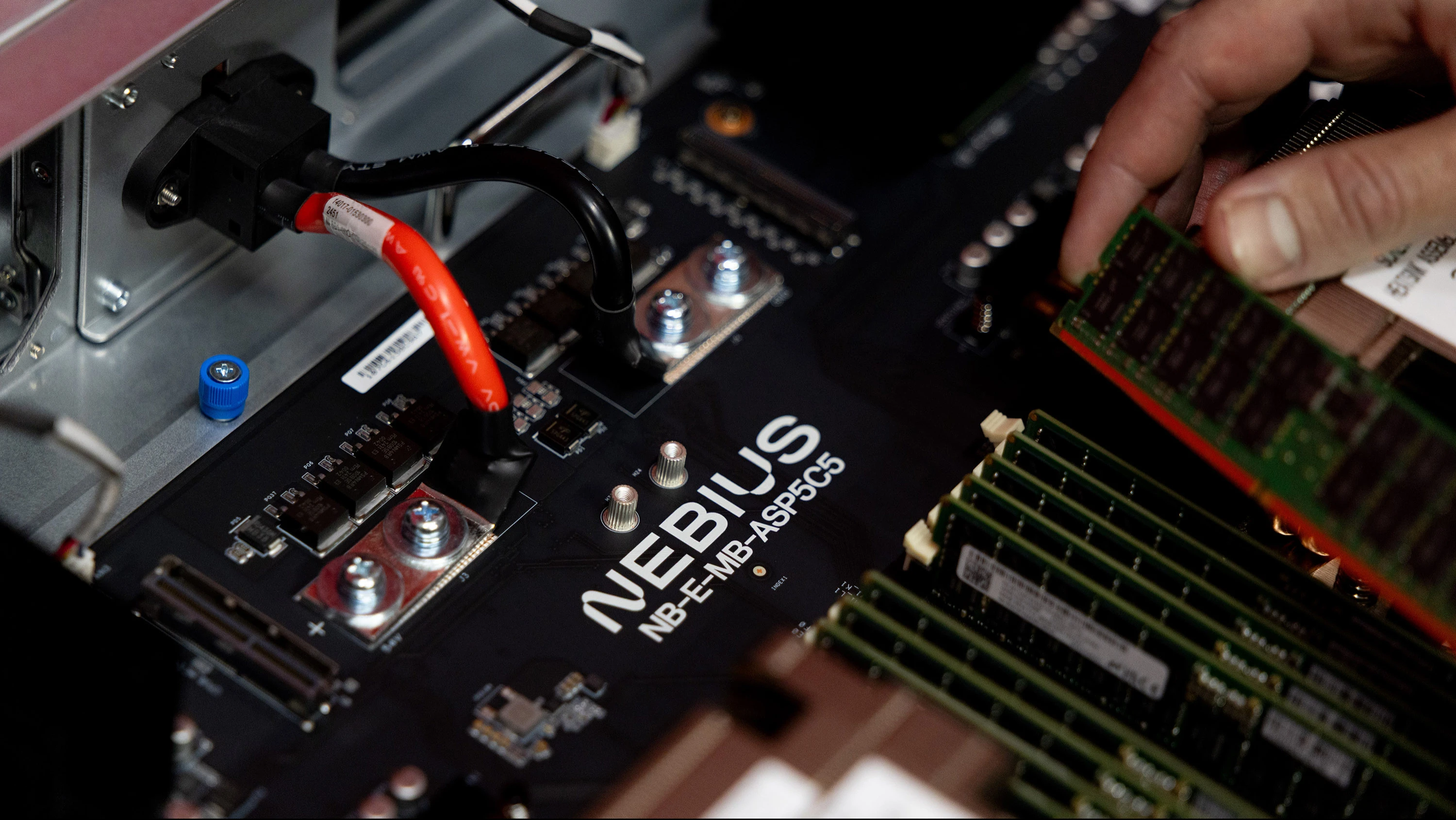

Nebius to buy a new type of search engine designed for AI agent queries / Photo: Nebius

Nebius Group, a cloud provider created by Arkady Volozh, a native of Kazakhstan and co-founder of Yandex, has agreed to buy software developer Tavily. The company creates software that helps AI agents find relevant information to perform tasks like programming or trading. Nebius could help boost its revenue.

Details

The purchase of Tavily is part of Nebius' strategy to create a single platform on which niche AI companies can build, customize and launch AI-based agents, Nebius said in a press release. Through the acquisition of Tavily, Nebius is expanding its toolkit for AI agent developers, the company added. In November, it launched Token Factory, a product that provides access to open source models and the computational resources to run them: Tavily will be a complement to it, it said.

Officially, the parties do not disclose the amount and terms of the deal. A representative of Nebius refused to comment on this matter to Bloomberg. But, according to the agency's source, Nebius will buy Tavily for $275 mln. Tavily founder and CEO Rotem Weiss and his team will join Nebius. The deal could be finalized within a few weeks.

The cloud provider announced the deal two days before publishing its report for the fourth quarter of last year. Nebius shares rose in price by almost 3% during trading on February 10, but the securities were volatile, going from up to down and back again.

What Tavily is for

Nebius calls Tavily a search service for AI agents. Autonomous agents working in trading, programming, customer service, travel and other areas need a new type of software to find information, Nebius co-founder and chief commercial officer Roman Chernin explained to Bloomberg. "They behave differently than people using the Internet," he noted. - Agents don't need a list of links. They are likely to repeatedly ask for information as they refine prompts. Unlike people who often give up if they don't get the answer they need on the first try."

Another challenge: the large language models (LLMs) that underpin AI services often lack up-to-date information or access to specific corporate data. "LLM models are great for discussing various topics, but beyond that you need to understand what is happening in real time," Chernin added. Tavily is developing software that can provide AI models with niche, highly specialized but relevant data.

The purchase of Tavily is in line with Nebius' goal to expand its service offerings to generate more revenue from its customers, according to Bloomberg. It's important for Nebius to form a "cohesive offering," Chernin noted. - In many cases, customers can prototype agents and other LLM-based AI products, but they need additional software tools to scale solutions, he added.

"Tavily has set its sights on connecting the next billion AI agents. Agent-based search is a multi-billion dollar market and we believe it is poised for exponential growth as enterprises adopt autonomous AI systems - said Rotem Weiss, founder and CEO of Tavily."

Last year, Tavily raised $25 million in investment from Insight Partners and other funds. Its clients include IBM and Cohere. The company competes with Nvidia-backed Exa Labs and has offices in New York and Tel Aviv.

Based in the Netherlands, Nebius is among the so-called neo-cloud companies specializing in selling computing power to AI customers. The company has data centers in the US, Europe and Israel. Its clients include Microsoft.

What analysts recommend

Nebius shares are now trading about 40% cheaper than their October 2025 peak. The stock is pressured by investor concerns about a possible bubble in the AI market, Seeking Alpha notes.

However, most analysts tracking Nebius shares recommend buying them, MarketWatch shows. The securities have eight Buy ratings and two Overweight ("above market") ratings, as well as two Hold (advice to hold) and one Underweight ("below market," consistent with a sell recommendation). The Wall Street consensus target price is $152.9, up 64% from the closing price on Monday, February 9th.

This article was AI-translated and verified by a human editor