Which small caps are benefitting from surging demand for nuclear power?

Many countries are rethinking past limits on nuclear power, given its role in meeting climate targets and bolstering energy security. In the U.S., a series of executive actions in May 2025 set an explicit goal to quadruple nuclear capacity to 400 gigawatts by 2050. They direct federal agencies to strip out unnecessary red tape, accelerate licensing, and spur construction of new reactors and uranium-enrichment facilities. Washington’s aim is to revive the domestic fuel cycle and curb import reliance – note the U.S. still buys roughly 20% of its enriched uranium from Russia.

Rising demand from AI infrastructure is another tailwind. Goldman Sachs Research estimates global data-center power consumption will rise 50% by 2027 and 165% by 2030 from 2023 levels. In August, Morgan Stanley lifted its outlook and now sees global nuclear capacity more than doubling by 2050, with up to $2.2 trillion in investment across the value chain. BofA Global Research has also noted that heavier data-center loads are increasing the need for low-carbon baseload, including nuclear – a shift that will require substantial grid upgrades even as it helps contain AI’s carbon footprint.

Tracking small cap beneficiaries

Oninvest analyst Aldiyar Anuarbekov has constructed the Nuclear Value Chain Equal Weight Index of 18 small-cap nuclear-infrastructure names, spanning upstream uranium (mining and conversion to the enrichment stage), fuel technologies, enrichment, and microreactors. The index is designed to show where new value is accruing along the chain.

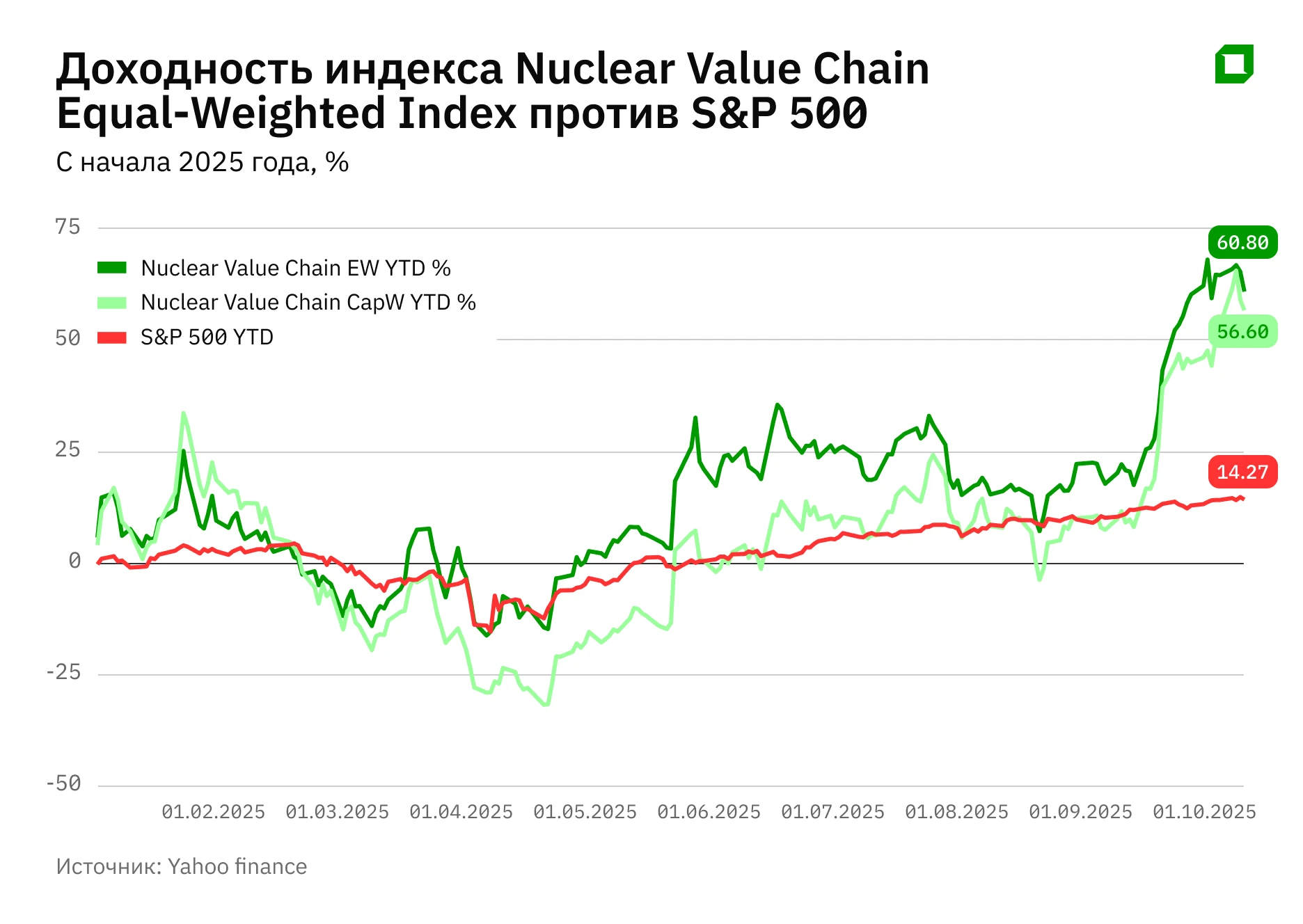

On Anuarbekov's numbers, the equal weight index rose 54% in 2023, 2% in 2024, and is up 61% year to date in 2025, for a CAGR near 40%.

A companion, capitalization-weighted version, the Nuclear Value Chain Cap Weight Index, climbed 29% in 2023, fell 4% in 2024, and is up 57% in 2025 to date, a roughly 27% CAGR. While both track small caps, the gap in returns suggests the rally has been broad-based rather than driven solely by a handful of larger constituents.

Company picks

The renewed interest in nuclear power opens room for technological breakthroughs, from next-generation fuels and modernized enrichment cycles to distributed generation based on small modular reactors (SMRs).

Against this backdrop, Anuarbekov highlights three notable small-cap players — Lightbridge, Silex Systems, and Nano Nuclear Energy. Each occupies a distinct niche in the nuclear value chain and is shaping the industry’s emerging architecture in its own way.

Lightbridge Corporation

Lightbridge, based in the U.S., develops an advanced metallic fuel for existing power reactors and SMRs. Its fuel, a uranium–zirconium alloy using high-assay low-enriched uranium (HALEU), is designed to increase thermal output, extend fuel cycles, and improve safety margins.

In 2025, six months ahead of schedule, Lightbridge and Idaho National Laboratory produced and qualified initial enriched alloy samples and prepared them for irradiation testing in the Advanced Test Reactor – a key milestone toward generating the performance data needed for licensing and utility demonstrations.

CEO Seth Grae, at the Atlantic Council's Nuclear Energy Policy Summit 2025, highlighted the faster-than-typical progress in the advanced fuel segment. If the next step – in-reactor testing and collection of performance data – is successful, it would clear the way for commercial trials of Lightbridge fuel in utility reactors.

Financially, the company reported no revenue in the second quarter of 2025; the net loss widened 45.8% year over year to $3.5 million, and R&D expense rose 77.8% to $1.6 million. Cash and equivalents stood at $97.9 million as of June 30. The shares have gained nearly 400% year to date as the company seems to be transitioning from pure R&D toward demonstration and early deployment.

Silex Systems

Australia’s Silex Systems is commercializing SILEX, a laser-based uranium-enrichment process. Silex owns 51% of Global Laser Enrichment (GLE), with Canada's Cameco, one of the biggest uranium producers in the world, holding 49% and serving as commercial lead. GLE is advancing the planned Paducah Laser Enrichment Facility in Kentucky; if licensed and built, it would be the first new U.S. enrichment plant in nearly two decades.

Silex’s market capitalization is about AUD2 billion ($1.3 billion). For the fiscal year ended June 30, 2025, revenue declined 5.5% to AUD12.20 million ($8.1 million), the net loss widened to AUD42.56 million ($28.1 million), and cash totaled AUD80.56 million ($53.2 million) with minimal debt.

The shares are up nearly 60% in 2025. The company has one rating from an analyst, who has a "buy" recommendation, according to MarketWatch data. One additional support is structural: Cameco holds an option to increase its GLE stake to 75% within a defined period after key SILEX milestones. Though that would have to be approved by U.S. regulators, this is a reminder of major players' engagement with laser enrichment and its potential to enhance U.S. supply independence.

Nano Nuclear Energy

Nano Nuclear Energy, founded in 2022, is developing portable and compact microreactors targeting 10-15 megawatts of electric output, alongside a vertically integrated fuel and services strategy. Noteworthy is that its chief technology officer is Florent Heidet, Ph.D., formerly played a central role in most of the Argonne National Laboratory's reactor design projects.

Its KRONOS high-temperature gas-cooled microreactor is being advanced toward a construction-permit application with the Nuclear Regulatory Commission, with a first-of-a-kind unit planned in collaboration with the University of Illinois Urbana–Champaign. BTIG analysts noted in a report that they expect it to start up around 2029 after receiving the relevant Nuclear Regulatory Commission approvals. In parallel, NNE is developing a second microreactor model and has a JV, LIS Technology, that will produce finished reactor fuel (including HALEU) for its own and third-party reactors. In September, the company announced that it had received a contract from the U.S. Department of Defense to study the possibility of deploying KRONOS at a military base.

In a report for the nine months ended June 30 2025, Nano Nuclear said cash on its balance sheet rose to $210.2 million from $28.5 million a year earlier. Operating expenses totaled $14.7 million and investing expenses totaled $12.9 million. The company's stock is up 70% since the beginning of the year. According to MarketWatch, it has four ratings from Wall Street analysts: three buy and one hold.

For the nine months ended June 30, cash rose to $210.2 million from $28.5 million a year earlier; operating outlays were $14.7 million, and investing outlays were $12.9 million. The stock is up about 70% year to date. According to MarketWatch, four analysts cover the shares, with three "buys" and one "hold" for their ratings.

The AI translation of this story was reviewed by a human editor.