With Quantum Computing up 3,591% for the year, Ascendiant Capital upgrades TP further

Shares of Quantum Computing could climb more than 62%, according to a new forecast by investment bank Ascendiant Capital Markets. The firm nearly doubled its target price, even though the shares have already surged 3,591% over the last 12 months. That is 201 times the return of the S&P 500 over the same period. Analysts say quantum technologies are developing "hand in hand" with ratcheting data generation, which has driven up the demand for high-performance computing.

Details

Ascendiant Capital Markets analyst Edward Woo reiterated his "buy" rating on Quantum Computing shares and boosted his price target to $40 from $22 per share, Barron's reports.

Shares surged 23% to $24.62 apiece on Friday, October 3, with Woo’s updated price target suggesting 62% upside even after the gains. In early trading today, October 6, the stock has given back 15% as of this writing.

Ascendiant Capital's rationale

Woo sees the technology going hand in hand with ratcheting data generation, which has driven up the demand for high-performance computing, Barron's writes. “By being early in this rapidly growing industry, we believe Quantum is well-positioned to capture and drive a meaningful market share and industry growth,” Woo was quoted as saying.

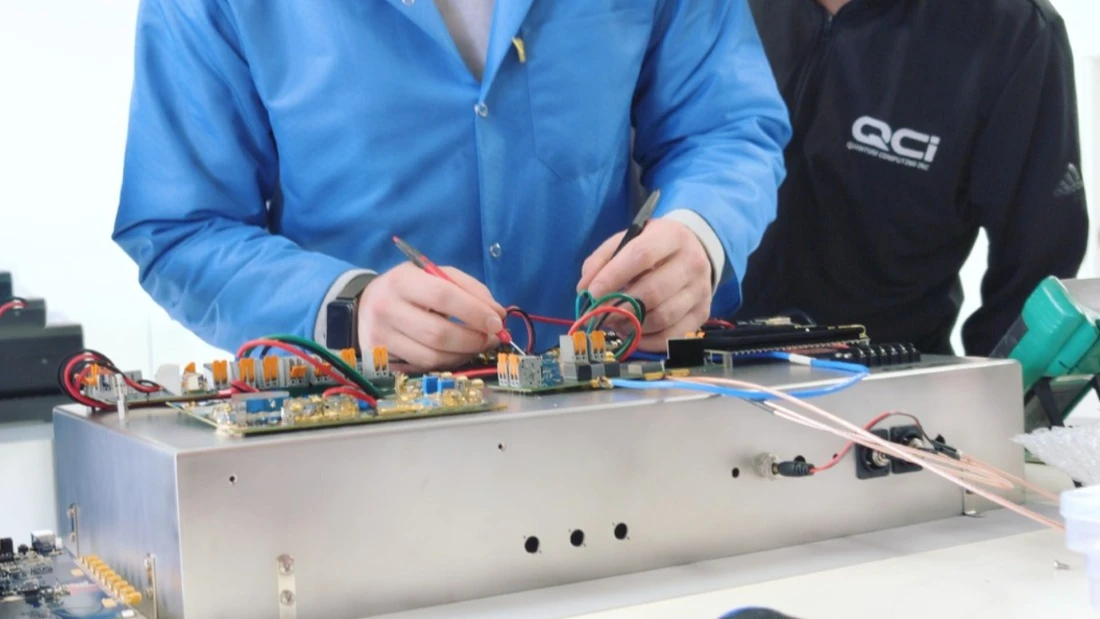

Quantum, unlike its competitors, has several business verticals. The company sells a quantum computer and produces a commercial entangled photon source to support research in quantum networking and secure communications. Woo notes "numerous orders" for these products. While Quantum reported a two-third year-over-year drop in revenue to $61,000 in the second quarter, Woo says that figure was in line with his forecast.

Context

Quantum computing stocks are volatile. The reason is ongoing discussions about the future of the industry. In January, Nvidia CEO Jensen Huang told analysts that getting “very useful quantum computers” to market could take 15 to 30 years. This caused segment stocks to plunge: on January 8, Quantum Computing, IonQ, D-Wave Quantum, and Rigetti Computing all plummeted around 40%.

Three months later, at Nvidia’s annual developer conference, Huang led a panel discussion featuring leaders of quantum computing companies and admitted he had been wrong. “My first reaction was, ‘I didn’t know they were public! How could a quantum computer company be public?’” Huang said.

Around the same time, in an interview with the Investor’s Business Daily in March, IonQ Chair Peter Chapman speculated that the quantum sector would experience a “ChatGPT moment." “If I was [OpenAI CEO] Sam Altman five years ago, would I have spent even any energy trying to convince the world that AI is coming?” Chapman said. “You could have had Sam Altman buck naked on a corner street in San Francisco with a sandwich board saying AI is coming, and no one would have listened."

Microsoft CEO Satya Nadella, speaking on a Microsoft earnings call in late July, said, "the next big accelerator in cloud will be quantum." This buoyed quantum computing stocks.

Stock performance

Over the last 12 months, shares of Quantum Computing have surged 3,591%. By comparison, the benchmark S&P 500 index has gained about 18%.

According to MarketWatch, Woo’s valuation is the most bullish on Wall Street. The average target price, based on the estimates of four analysts, stands at $26.33 per share, implying upside of about 7%. The stock has three “buy” ratings versus one “hold."

The AI translation of this story was reviewed by a human editor.