XPeng shares soar over 'most human-like' robot. Is it a threat to Tesla?

The Chinese electric car maker's stock is still relatively cheap, according to Seeking Alpha analyst Ricardo Fernandez

Quotes of Chinese electric car maker XPeng jumped to the highest level in more than three years amid increased interest in its new product - a humanoid robot capable of competing with Optimus from Tesla. Although Tesla and XPeng are choosing different strategies and price segments for their new products, the Chinese company's success could put pressure on Tesla stock.

Details

XPeng shares rose 18% in Hong Kong on Nov. 11 to their highest since July 2022, posting their biggest one-day gain in more than two years. The company's American Depositary Receipts (ADRs) are up 5% on the New York premarket after rising 16% a day earlier.

Quotes soared amid growing optimism about the Chinese electric car maker's progress in technology, including humanoid robots, Bloomberg notes. In addition, the market now expects XPeng to report earnings as early as the third quarter of 2025, although it was previously projected that profits would not appear until the fourth quarter, The Wall Street Journal writes, citing Bocom International analyst Angus Chan.

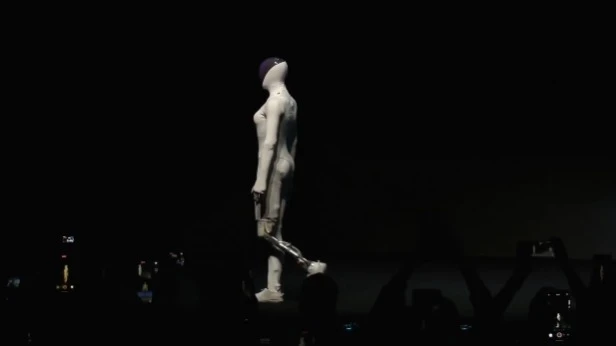

Unlike the utilitarian appearance of the Tesla Optimus, the design of the IRON robot presented by XPeng is based on the principle of "extreme anthropomorphism". The Chinese Optimus competitor is equipped with a human-like spine, bionic muscles and flexible synthetic skin. XPeng plans to bring the "most human-like" robot to market as early as 2026, ahead of Tesla, The Street notes.

However, the companies' approaches to market entry differ significantly. Tesla is betting on fast scalability, availability and application of Optimus in production processes, while XPeng plans to use its robot in commercial spheres with direct interaction with customers - as tour guides and administrators. The main disadvantage of IRON is its high price: it can cost about $150 thousand, which is many times higher than the price of Optimus announced by Tesla, Tech Digest notes. Tests have shown that the XPeng robot is unprofitable to use in production - its expensive and complex arms quickly wear out.

What other analysts are saying

Morgan Stanley raised the target price of American depositary receipts XPeng from $30 to $34 and reaffirmed the rating "above market" (Overweight, corresponds to the recommendation to buy). The key reasons for the adjustment of the price target Morgan Stanley called the growth potential and the possibility of revaluation of securities arising from the announcement of a humanoid robot and robotaxi XPeng, reports Investing.com.

Seeking Alpha analyst Ricardo Fernandez also advises to buy XPeng shares. He says XPeng's securities are relatively cheap compared to many of its peers, with a higher growth rate. "If the launch of robotaxis and mass production of robots in 2026 materializes and meets market demand, it could change the overall narrative and cause XPeng stock to be revalued to levels comparable to Tesla or cause a downward revision of Tesla's valuation," he wrote.

According to FactSet, the vast majority of analysts - 33 out of 39 - recommend buying XPeng stock (Buy and Overweight ratings), five take a neutral view (Hold) and only one advises selling (Sell).

This article was AI-translated and verified by a human editor