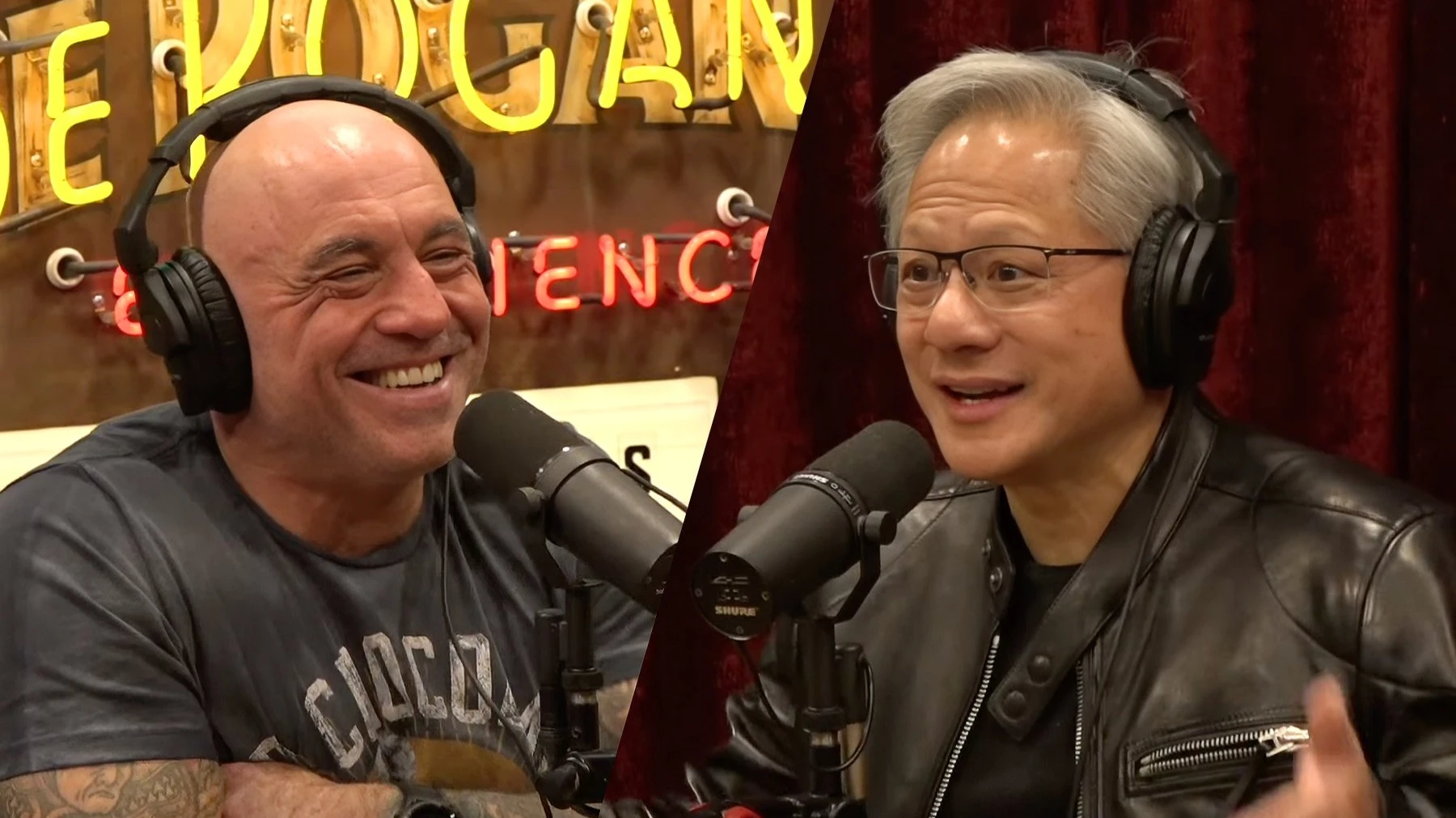

AI, the singularity and robots: what did the head of Nvidia reveal on Joe Rogan's podcast?

Nvidia CEO Jensen Huang is one of the most influential visionaries of our time. Not only is his company the largest in the world based on market capitalization, but it is also at the epicenter of a global technology revolution, making his public appearances important to investors.

In early December, Huang was a guest on Joe Rogan's podcast, where for two and a half hours he shared his vision for the coming decades. We analyzed the key messages from that conversation.

The AI race is the most important in history

Huang draws a direct analogy between the current race for AI leadership and historical technological breakthroughs, including the Industrial Revolution and the Manhattan Project to build the atomic bomb. In his view, AI leadership is the most important race in the world right now. This technology gives countries "superpowers" - whether information, energy or military.

The head of Nvidia strongly supports the idea of bringing manufacturing back to the US. He explains it pragmatically: critical technologies should be produced "at home" for the sake of national security and preserving jobs.

Conclusion for investors: developed countries are moving from service economies back to "heavy" industries. Construction companies, manufacturers of industrial equipment and robotics are getting a strong impetus for development due to government protectionism and increased investment.

Energy is the foundation of AI growth

Today, the industry's bottleneck is not chips, but energy: data centers and AI factories are constrained by available power. Huang predicts a boom in small nuclear power plants and local generation around large data centers.

However, the Nvidia CEO is optimistic about the growth of AI energy efficiency. He estimates that over the past ten years, computing efficiency has already increased by orders of magnitude, and this process will continue, which will make the energy cost of solving typical AI tasks for the end user "microscopic".

The takeaway for investors: the AI story is not just about Nvidia and "big models," but also about the long investment cycle in energy, from grid infrastructure to energy equipment manufacturers.

Jobs, occupations and robots: automation removes tasks, not goals

Huang recalls old predictions that AI would completely take jobs away from radiologists because it was incomparably faster than humans in analyzing X-rays. But in reality, the number of radiologists has grown because they can now do more exams for more patients. And more radiologists are needed to serve more patients.

From this he derives a general principle: the purpose of the profession is more important than specific tasks. A lawyer's goal is to help people, and reading documents is just one of the tools. Where the profession is a set of tasks (pure routine, like cutting vegetables), people will indeed be displaced. But in parallel, new industries are emerging - for example, around household and industrial robots: manufacturing, repair, customization of appearance, and so on.

Conclusion for investors: AI is becoming a horizontal technology. It is already worth looking for companies that are using AI to strengthen already strong businesses and building future service ecosystems around "robotic living" and industrial automation.

AI security requires... even more power

Contrary to fears that powerful AI will become dangerous, Huang argues the opposite: power is necessary for safety. Today's models spend enormous computational resources checking facts, searching for contradictions, and reducing hallucinations before giving an answer.

He draws an analogy with cars: more "horses" in the motor today largely goes not into speed, but into ABS, traction control and other safety systems. In AI, he says, the next order of power growth will also go into reasoning, planning and introspection, not just spectacular stunts.

The upshot for investors is that demand for computing power will not drop even as new model learning slows.

Evolution, not a sudden explosion

Huang is skeptical about predictions of a sudden "singularity" - a moment when AI will rapidly evolve into something beyond human control. He sees progress as a gradual process: technology improves every day, and humanity adapts to it just as smoothly.

Conclusion for investors: leaving existential risks aside, this vision supports the idea of a stable, long-term deployment of the technology. It is also an argument against the concept of an AI bubble that is bound to burst.

The threat of quantum computing and the cycle of technological renewal

When asked whether quantum computers will break modern encryption, Huang answered in the affirmative. However, he is calm: the industry is already developing post-quantum security algorithms.

The conclusion for investors is that the technology sector is cyclical in solving the problems it creates. The threat of quantum hacking will create a boom in the next-generation cybersecurity sector. This is a perpetual driver of demand for innovation.

Nvidia's history and personal philosophy

In the part about the history of Nvidia, Huang tells us that the company was literally "on the rocks" several times. First - the wrong choice of 3D graphics architecture, when all the key technical decisions turned out to be wrong, and the product had to be actually thrown out. Later - a bet on the CUDA computing architecture: it sharply increased the cost of chips, the market did not understand it, and the capitalization of Nvidia from about $12 billion collapsed to $2-3 billion.

He describes it as an informed risk: if you have real faith in the future architecture based on first principles and don't bet just because of market fear, you'll regret it for life.

His personal style is to work seven days a week, to be constantly on alert for the future of the company while recognizing the role of luck and the support of others in Nvidia's success story.

This article was AI-translated and verified by a human editor