Better than bitcoin: miners overtake cryptocurrency in 2025 - what to expect next?

Companies began to use data center infrastructure not only for mining, but also for AI and cloud computing tasks / Photo: Shutterstock.com

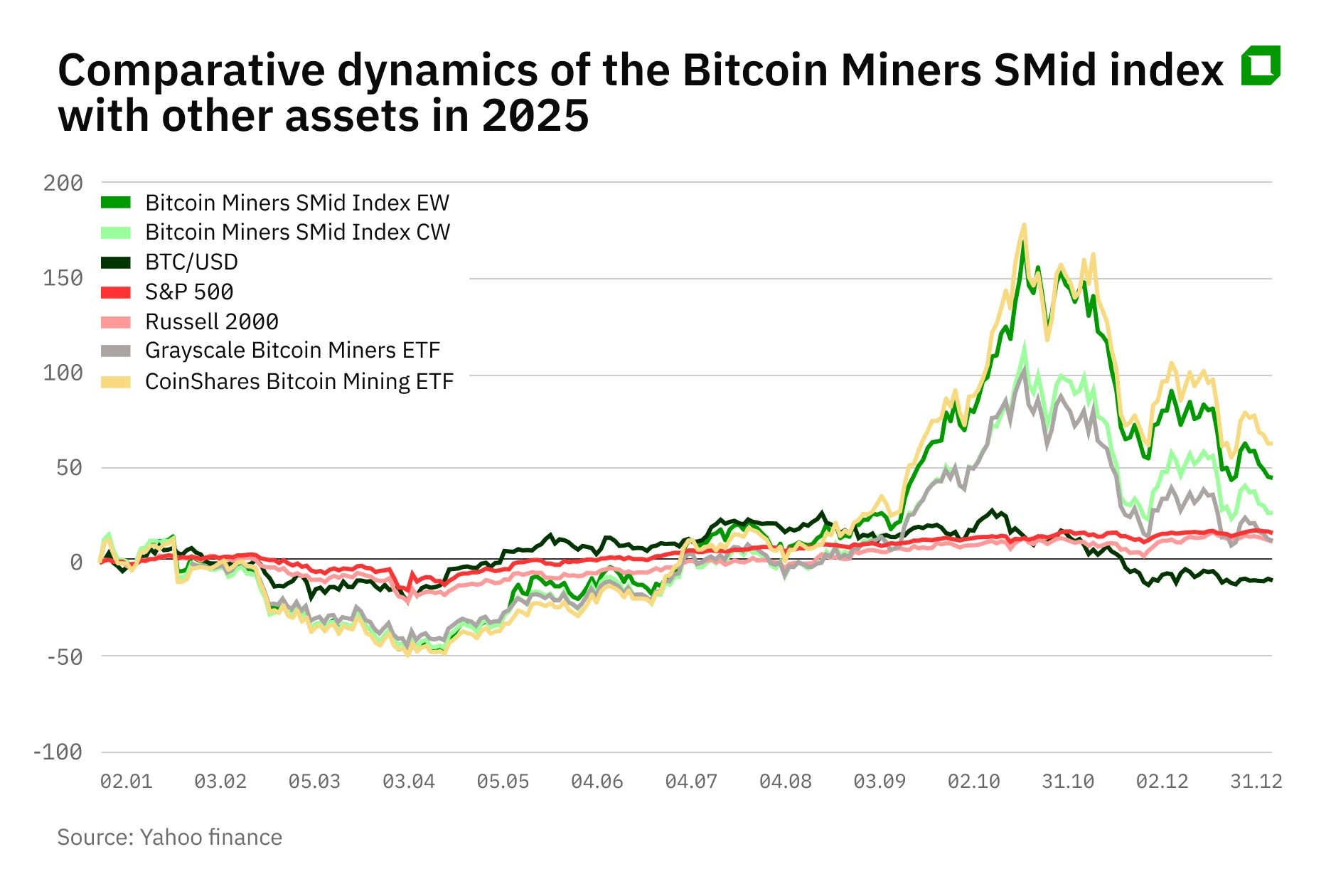

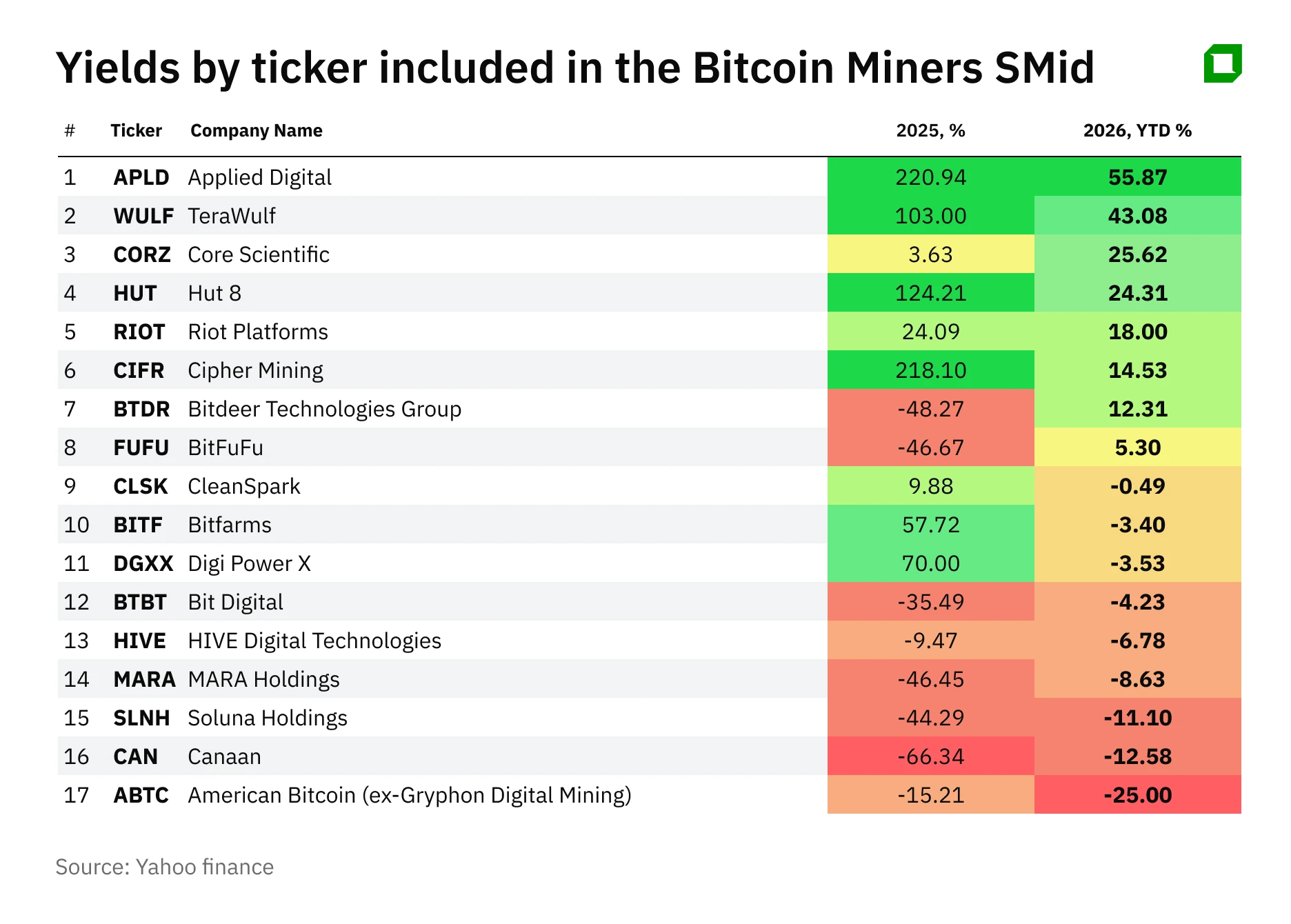

In 2025, the bitcoin mining sector rebounded strongly and outpaced the growth of the cryptocurrency itself. The equal-weighted Bitcoin Miners SMid Index EW, calculated by analyst Aldiyar Anuarbekov for Oninvest, grew by 46%. The index includes 17 mining companies of small and medium capitalization. The index, weighted by market capitalization of Bitcoin Miners SMid Index CW, added 27%. By comparison, the price of bitcoin itself fell 9.7% in 2025, while the S&P 500 broad market index rose 16.3%. In 2026, the market is betting on companies that combine mining with infrastructure for artificial intelligence.

From mining to digital infrastructure

The main driver of growth last year was a change in business model: miners began to use their data centers more actively for high-performance computing - primarily for AI tasks and cloud services. Increased competition in the network (total computing power increased from 0.8 to more than 1.1 ZH/s by the end of the year) and lower profitability after the 2024 halving forced companies to look for new sources of revenue.

As a result, many operators began positioning themselves as digital infrastructure providers. The market supported this turnaround: according to CoinShares data, miners' shares rose on the back of news of partnerships in the data center segment, including a major deal between miner Hut 8 and cloud startup Fluidstack. As a result, even with bitcoin's weak performance, the industry index ended the year with outperformance thanks to capacity scaling and a new investment story around AI and infrastructure.

Aldiyar Anuarbekov selected three companies from the Bitcoin Miners SMid Index EW, with growth prospects in 2026.

Applied Digital (ticker APLD)

Applied Digital is one of the fastest-growing companies of 2025, with its stock soaring about 221% and adding about 37% more since the start of 2026. The company, formerly a miner, has shifted its focus to the high-performance data center business - it builds and leases powerful AI, cloud and blockchain computing facilities. By the end of 2025, Applied Digital already had a large-scale contract (400 MW) with CoreWeave, one of the AI industry leaders. Now Applied Digital is in the final stages of negotiations with the new tech giant to host three new centers with a combined capacity of up to 900 MW. The company does not disclose the names of the companies, but according to analysts at Northland Securities it could be Amazon, Microsoft or Google.

For the second quarter of fiscal 2026 (ended November 30, 2025), Applied Digital's revenue increased 250% year-over-year to $126.6 million, while net loss attributable to shareholders decreased 76% year-over-year to $31.2 million.

Analysts at Northland Securities in January raised their target price on Applied Digital's stock to $56 - about 58% above its current value. The Northland report noted that Applied Digital partners with five of the six largest cloud providers in the U.S. and has a 4.3GW portfolio under active development. The strategic repositioning has allowed the company to outperform most of its competitors in 2025 and, according to experts, ensures that it stands a good chance of maintaining its sector leadership position in 2026. Applied Digital stock has 14 Buy ratings from Wall Street analysts, according to MarketWatch. The average target price is $49.8, suggesting a potential upside of about 48% from the closing price on Feb. 17.

TeraWulf (WULF)

Shares of bitcoin miner TeraWulf rose 103% in 2025, and since the beginning of 2026 have already risen by more than 40%. By the beginning of 2026, TeraWulf's total energy base has increased to 2.8 GW thanks to the purchase of two industrial sites in Kentucky and Maryland. According to Needham analysts, TeraWulf is in talks with investment-grade hyperscalers and is discussing possible projects with Fluidstack and Google. Company executives did not disclose details, but also hinted at a possible deal to lease capacity to a large AI customer.

In Q3 2025, TeraWulf generated recurring revenue from HPC capacity rentals for the first time - $7.2 million on total quarterly revenue of $50.6 million, an 87% year-over-year increase. Thanks to low power costs (0.04-6.0 cents per kWh), the company remains profitable even with bitcoin volatility. In the third quarter, the cash cost of mining one bitcoin was $44,729 with an average realized price of $115,053, representing 38.9% of value. GAAP net loss of $455.1 million, which is not due to a decline in operating efficiency, but to non-cash revaluations of derivatives and warrants that are subject to market conditions. On metrics that better reflect current operations, the situation looks different: Adjusted EBITDA grew 202.8% year-on-year to $18.1 mln.

In February, Needham analysts assigned a Buy rating to TeraWulf shares with a target price of $21, noting the monetization potential of the new 1.5 GW of capacity and the expected rapid effect from its lease. In their assessment, the company is one of the most suitable miners to reposition capacity for HPC. The stock has 14 Buy ratings from Wall Street analysts and an average target price of $23.17. The stock has a 43% upside potential.

Hut 8 Corp (HUT)

Hut 8 Corp. more than doubled its market capitalization last year, with shares adding 15% since the start of 2026. The company is among the top 10 largest holders of mined bitcoin. In 2025, Hut 8 Corp. made a strategic U-turn by commercializing its infrastructure assets. A key milestone was the award in December of a 15-year contract with Fluidstack for 245 MW of computing capacity at its new River Bend campus in Louisiana. The deal is valued at $7 billion with the potential to grow to $17.7 billion at renewal. The financial guarantor was Google, which assumed the tenant's obligations for the entire term of the base lease. HUT shares soared on the day the deal was announced on Dec. 17, and analysts noted a qualitative transformation of the business.

The River Bend deal hides a much greater potential: Google's participation and the possibility of expanding the project beyond 1 GW create additional sources of value for Hut 8 beyond the basic conditions, according to analysts at Roth Capital. In fact, the company is turning into a large data center operator with long-term contracts and global technology partners. Roth Capital raised its target price on the stock to $80, given the prospect of capacity growth. This means the company's stock could rise by almost 50% from its current value.

Meanwhile, Hut 8 continues to mine - after merging with US Bitcoin Corp. the combined hashrate reached 25 EH/s, one of the largest in North America - and operates its own commercial data centers in Canada, providing diversification. According to MarketWatch, all 16 Hut 8 ratings from Wall Street analysts are Buy. It has an average target price of $69.8 and an upside potential of nearly 32%.

What to expect in 2026.

In January 2026, shares of mining companies continued to grow despite the weak dynamics of bitcoin. According to JPMorgan, the total capitalization of 14 public miners in the U.S. increased over the month by 23% to $60 billion, with twelve of the fourteen securities overtaking bitcoin in terms of yield. The growth is largely due to a temporary decrease in competition in the network: strong winter storms in the U.S. forced some operators to stop capacity, which led to a reduction in global computing power by about 6%.

This temporarily improved the economics of operating companies, with JPMorgan estimating that mining profitability was up 24% from December. As a result, the industry index of miners in January noticeably outperformed both bitcoin and the broad market. That said, mining profitability remains below pre-halving 2024 levels. The dynamics of the beginning of 2026 shows a change in attitudes towards the sector: investors increasingly perceive miners as operators of digital infrastructure, not only as participants in the crypto market.

According to CoinShares, diversification into AI and cloud services is not weakening the bitcoin network: aggregate computing power continues to renew highs, indicating the industry's resilience and ability to adapt. This trend is likely to continue in the near term, with data center operators looking to monetize the growing demand for computing resources while containing costs. The sector enters 2026 with strong dynamics. Market participants do not give direct investment recommendations, but current assessments indicate that companies that combine mining with AI infrastructure are best positioned for further growth.