Biggest small-cap winners from the 2025 gold rally and what to expect in 2026

Gold soared 64.5% in 2025 versus a 16.4% gain for the S&P 500 / Photo: Shutterstock.com

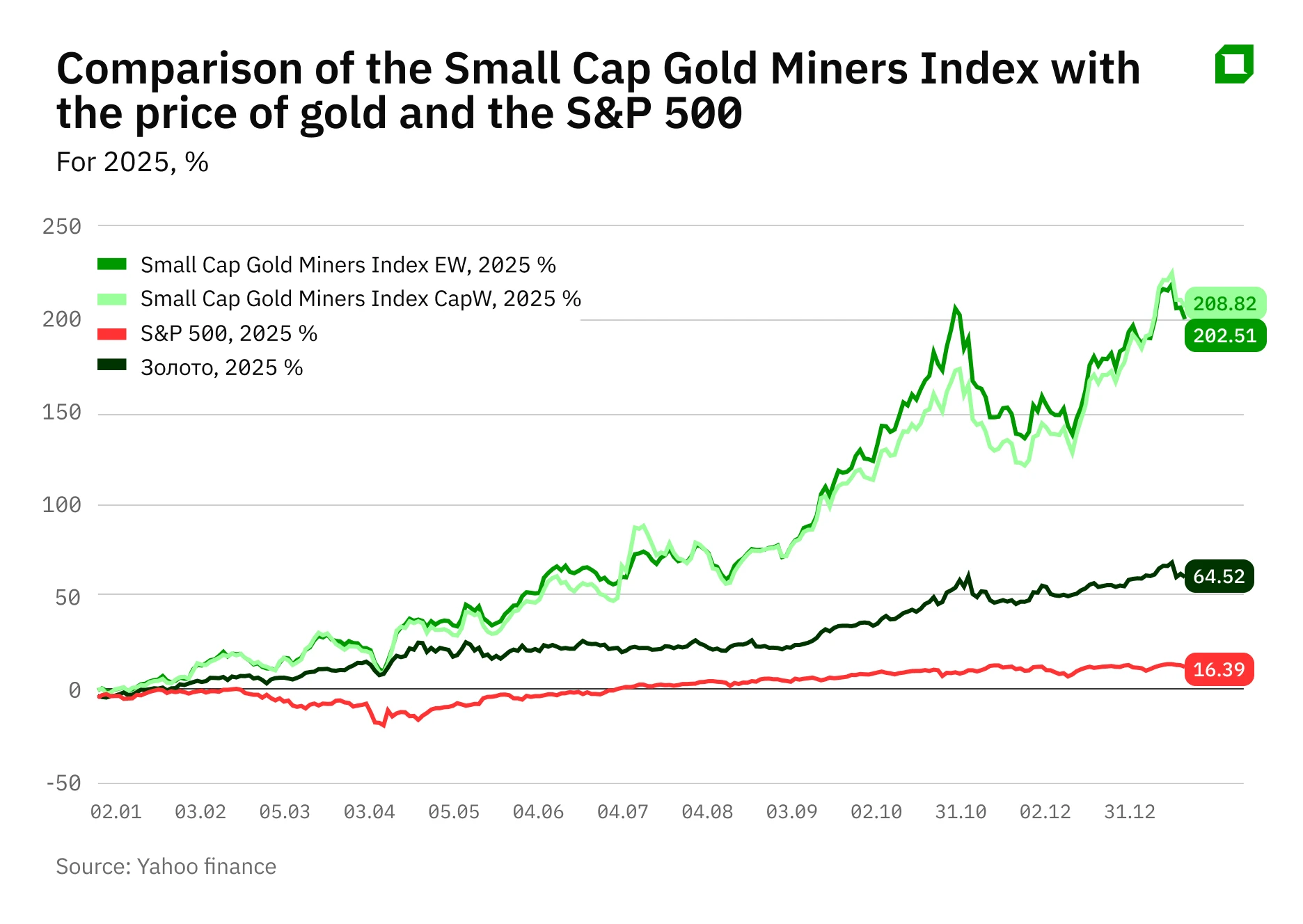

One of the main beneficiaries of the 2025 gold rally was small-cap mining companies. The Small Cap Gold Miner Equal Weight Index, assembled by analyst Aldiyar Anuarbekov specially for Oninvest and including 45 gold producers with market capitalizations of up to $2 billion (see the note on index composition below), soared 202.5% in 2025. Meanwhile, the Small Cap Gold Miner Cap Weight Index skyrocketed 208.8% last year. Both indexes significantly outperformed both gold itself and even equities: the precious metal gained 64.5% – its best performance in 46 years – while the S&P 500 added 16.4%.

Such strong outperformance reflects the high sensitivity of junior miners’ shares to gold prices: amid the rally in the metal, investors looked for how to get the maximum return from the rising prices, which small mining companies can provide. An additional factor was improving operating performance at a number of previously unprofitable or stagnating players, with higher production supporting their financial results.

For example, Americas Gold and Silver increased silver production by more than 50% over the year, and against the backdrop of record-high metal prices this translated into a sharp acceleration in revenue growth. Institutional investors were quick to recognize the improvement in operating performance: the number of funds among the company’s shareholders rose from two to 78 in a single quarter, reflecting a broader influx of capital into junior miners as a group.

Anuarbekov highlights three gold mining stocks from the Small Cap Gold Miner index that look set to extend their gains into 2026.

Kingsgate

Kingsgate Consolidated (KCN) is an Australian gold mining company known for the Chatree mine in Thailand, one of the largest in Southeast Asia. After years of downtime following the suspension of operations in 2017, the mine restarted in 2023, and the company is keen on increasing production.

Kingsgate shares rose 371.9% in 2025, supported by a surge in production at Chatree – up 92% for gold and 33% for silver – and a historic gold price rally that expanded margins. By year-end, the company had accumulated about $126 million in cash and product.

Canaccord Genuity in November raised its target price on Kingsgate shares to $9.30 per share (implying 74% upside) and upgraded its rating to “buy.” According to the analysts, further growth will be driven by rising output at Chatree – toward 100 thousand ounces of gold in 2026 – and expanding free cash flow. Institutional interest is already rising: the shares are included in the VanEck Junior Gold Miners ETF (GDXJ; 0.32% of the portfolio, about $33 million), while the likes of the Franklin Gold and Precious Metals Fund (FKRCX) and the Global X Silver Miners ETF (SIL) built positions through 2025. According to MarketScreener data, the stock has two ratings – “buy” and “hold.” The average target price is AUD7.90 per share, implying upside of about 48% versus the closing price on Monday, February 9.

Gold Resource Corporation

Gold Resource Corporation (GORO) is a U.S. gold mining company with key assets in Mexico. Its main mine is the Don David (Arista) underground mine in Oaxaca, which includes its own processing plant producing doré bars and base-metal concentrates. The company is headquartered in Denver and maintains full control over its operations in the region.

The fourth quarter drove a strong turnaround in operating performance. The final period of the year accounted for 45% of annual output following the launch of the high-grade Three Sisters area, which lifted gold and silver grades. Against the backdrop of record prices – realized levels of about $55 per ounce for silver and $4,234 per ounce for gold – the company's financial results improved markedly in the fourth quarter. The company ended 2025 free of debt with $25 million in cash versus a capital deficit a year earlier. This improvement has been a key driver of gains.

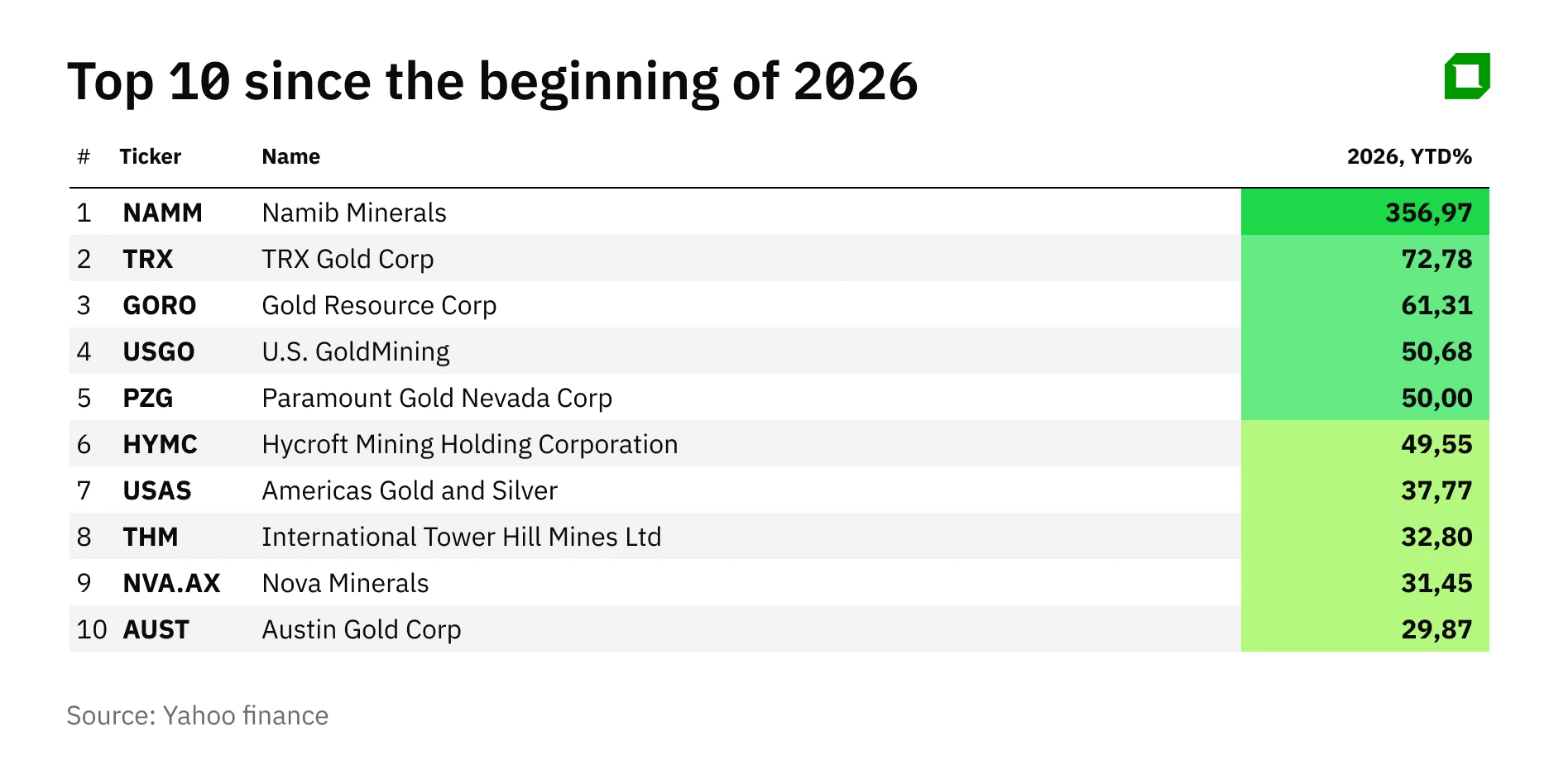

Gold Resource has been a top performer in 2025 and now in 2026, with its shares adding 277% and more than 100% in those periods, respectively. Analysts at H.C. Wainwright reiterated their “buy” recommendation and raised their target price from $1.25 to $2.00 per share, implying further upside of almost 20% versus the closing price on Monday. Additional support came from an influx of institutional capital, with hedge funds and investment funds holding 18% of the stock as of the end of 2025 and firms such as Two Sigma, Jane Street, and Virtu increasing their positions in the second half of the year. Gold Resource shares have two “buy” ratings, according to MarketWatch data. Their average target price is $1.63 per share.

Americas Gold and Silver (USAS)

Americas Gold and Silver (USAS) is a North American mining company specializing in precious metals – primarily silver – and antimony. Its key assets are the Cosalá silver mines in Mexico and the Galena Complex in Idaho, U.S. The company also owns the Relief Canyon gold project in Nevada, currently in care and maintenance.

Last year was a "transformative" one for USAS. The company increased silver production by 52% to a record 2.65 million ounces, and the volume growth coincided with a favorable pricing environment that significantly strengthened cash flow, as noted by CEO Paul Andre Huet. Operational improvements were supported by investments: in the summer of 2025 the company raised $100 million in debt financing to modernize assets, accelerating expansion at Galena. An additional driver was the identification of new promising ore zones in Idaho, which also strengthened the long-term growth outlook.

Shares of Americas Gold and Silver rose 424.1% in 2025 and have added another 56.6% since the beginning of 2026. In January, H.C. Wainwright doubled its target price on the stock from $4.90 to $9.75 per share while reiterating its “buy” recommendation after strong fourth-quarter production results. According to MarketWatch data, all six analysts covering the stock have “buy” ratings. The average target price is $10.15 per share, implying upside of 26.8%.

What to expect in 2026

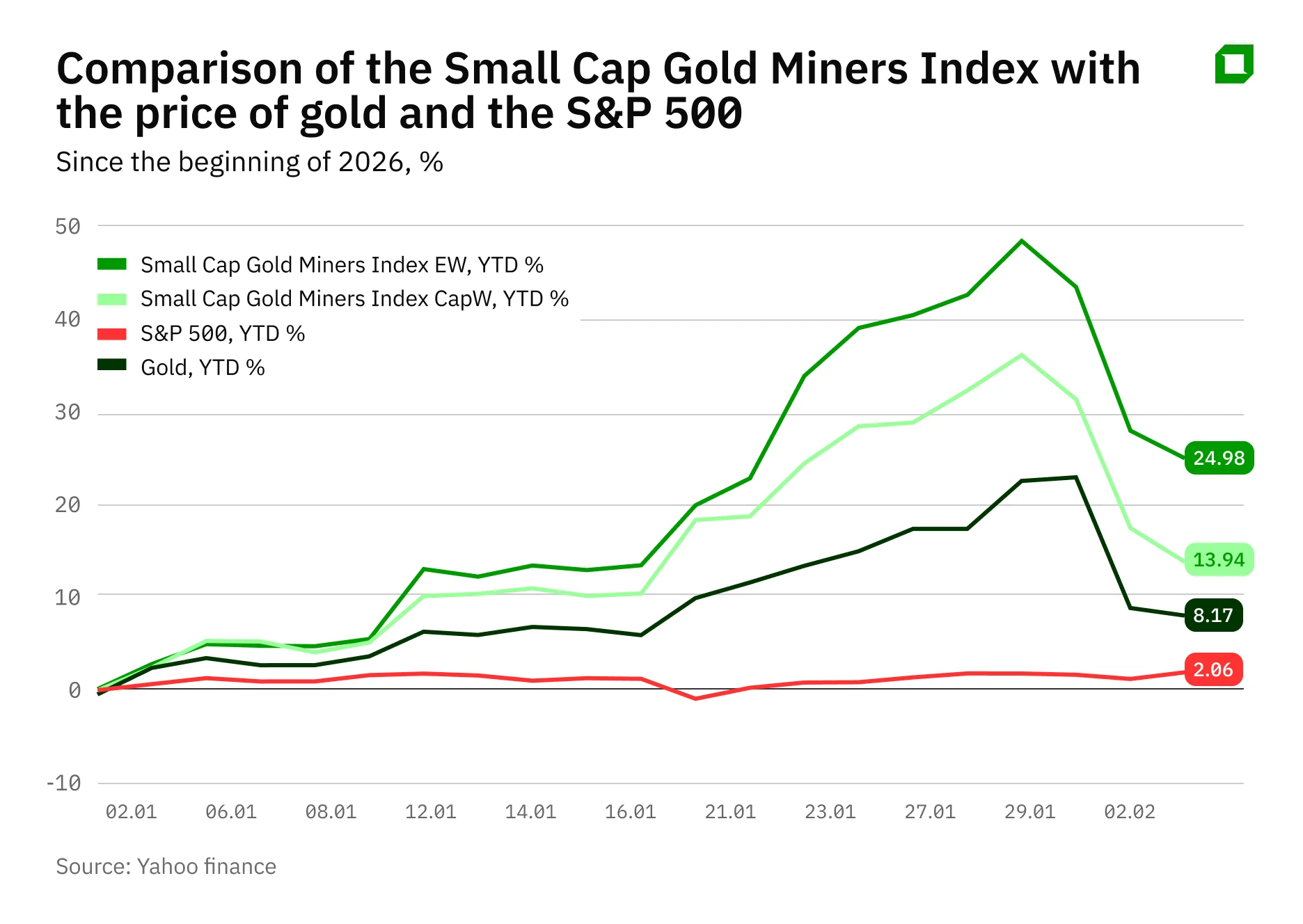

Small-cap gold miners have maintained strong momentum at the start of 2026. Between early January and early February, the EW Index gained about 25%, continuing to outperform both gold and the broad equity market. The backdrop for the sector remains favorable, with gold prices recovering quickly after a late-2025 selloff and again approaching $5,000 per ounce. Even after the correction at the end of January – a drop of about 21%, from $5,600 to $4,430 per ounce – prices began to recover and by February 3 were moving back toward the $5,000 per ounce level.

The sector's growth may continue on the back of steady investment demand, geopolitical uncertainty, and active purchases by central banks. However, according to Bloomberg Intelligence, gold mining stocks have already largely priced in the metal’s rally: the average EV/EBITDA multiple of around 5.4 is close to the 10-year cyclical level of 5.7, and the market is not yet factoring in further gold price growth without a period of consolidation. In addition, repeating the extreme financial outperformance of 2025 may prove difficult for gold miners: in the second half of the year, margins could come under pressure from rising royalties, personnel, and equipment costs even if gold prices remain high.

Note: The index now includes 45 gold mining companies instead of 49 previously, as four names were excluded due to delistings, mergers, or acquisitions.

This material does not constitute individualized investment advice.