Bitcoin miners outperformed the cryptocurrency in 2025. What about 2026?

Data center infrastructure is increasingly being used for AI and cloud computing tasks / Photo: Shutterstock.com

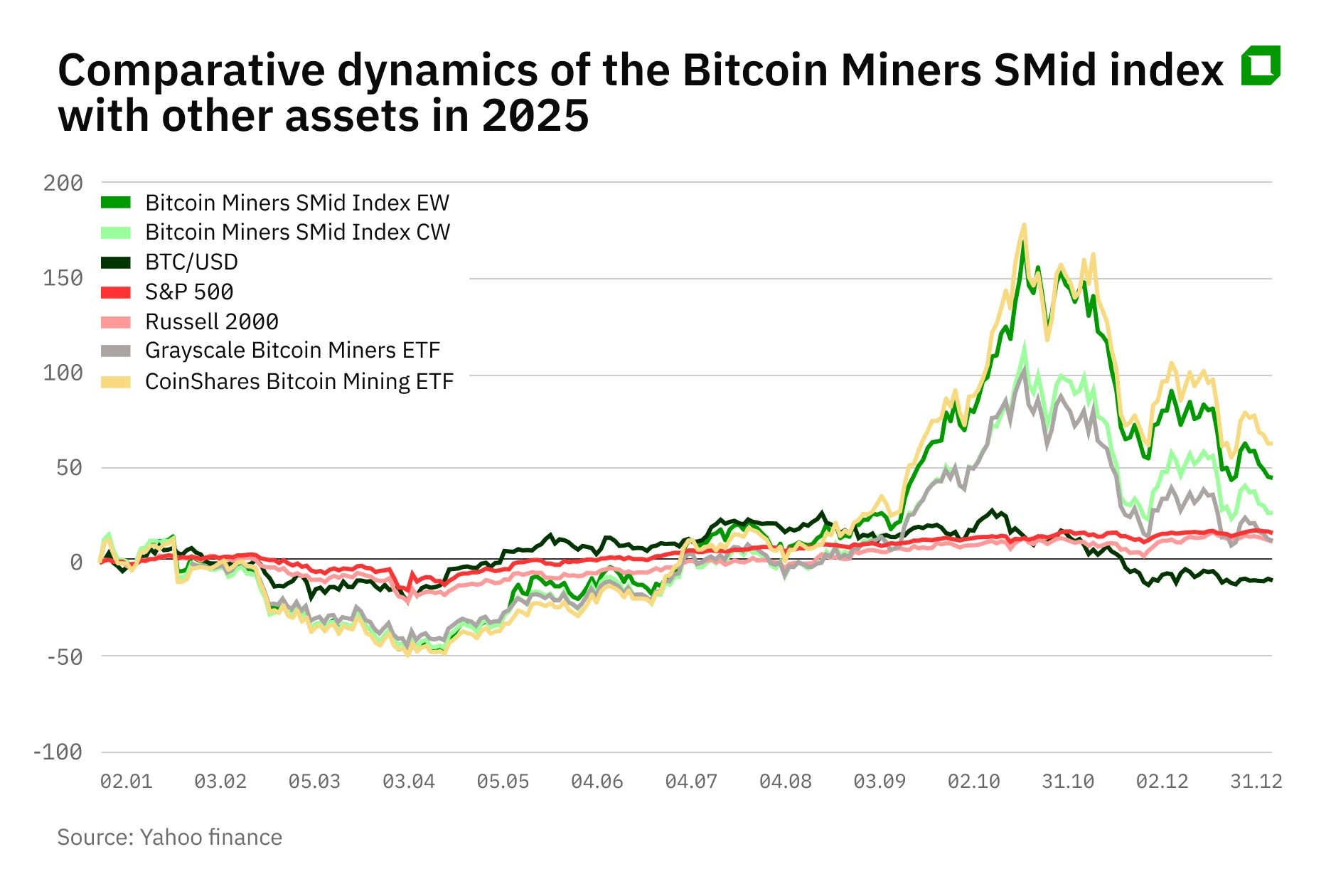

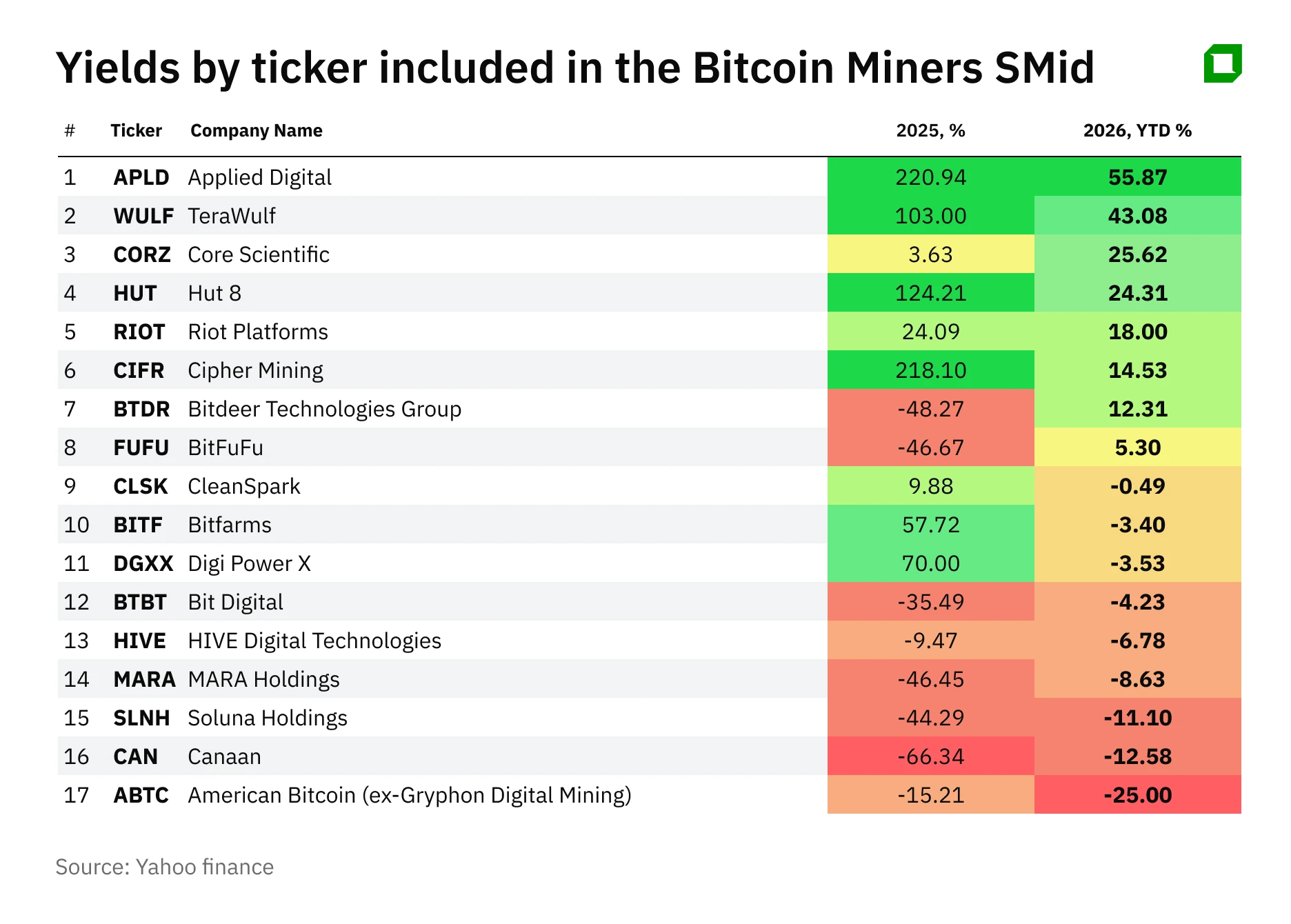

In 2025, the bitcoin mining sector rebounded strongly and outpaced the performance of the cryptocurrency itself. The Smid-cap Bitcoin Miner Equal Weight Index, put together by analyst Aldiyar Anuarbekov for Oninvest, gained 46%. The index includes 17 small- and mid-cap mining companies. Meanwhile, the Smid-cap Bitcoin Miner Cap Weight Index added 27%. By comparison, bitcoin fell 9.7% in 2025, while the S&P 500 rose 16.3%. In 2026, investors are increasingly betting on companies at the intersection of mining and AI infrastructure.

2025 trends

The main driver of growth last year was a change in business model: miners began to use their data centers more actively for high-performance computing - primarily for AI tasks and cloud services. Increased competition in the network (total computing power increased from 0.8 to more than 1.1 ZH/s by the end of the year) and lower profitability after the 2024 bitcoin halving forced companies to look for new sources of revenue.

As a result, many operators began positioning themselves as digital infrastructure providers. The market supported this shift: according to CoinShares data, miners’ shares rose on news of partnerships in the data-center segment, including a major agreement between Hut 8 and cloud startup Fluidstack. Even with bitcoin’s weak performance, the industry index saw outperformance last year, supported by capacity expansion and a new investment case around AI and infrastructure.

Below Anuarbekov takes a closer look at three companies from his index that offer solid upside this year.

Applied Digital

Applied Digital (APLD) was among the highest-returning stocks in 2025, with its stock up about 221% then and adding roughly 37% more since the start of 2026. The company, previously focused on mining, has shifted toward high-performance data centers, building and leasing infrastructure for AI, cloud, and blockchain workloads. In 2025, Applied Digital secured a 400 MW contract with CoreWeave, an AI infrastructure leader. The company is now in advanced negotiations with another technology group to host three new data centers with combined capacity of up to 900 MW. While the company does not disclose the names of the counterparties, analysts at Northland Securities say it could be Amazon, Microsoft, or Google.

For the second quarter of its fiscal 2026, ended November 30, 2025, Applied Digital saw revenue rise 250% year over year to $126.6 million, while the net loss attributable to common stockholders narrowed 76% year over year to $31.2 million.

In January, Northland Securities raised its target price on Applied Digital to $56 per share, about 58% above current levels. It argues that the company works with five of the six largest cloud providers in the U.S. and has a 4.3 GW portfolio under active development. A strategic repositioning allowed the company to outperform most peers in 2025 and positions it to maintain leadership in the sector in 2026, Northland believes. Applied Digital has 14 “buy” ratings from Wall Street analysts, according to MarketWatch data. The average target price is $49.80 per share, implying upside of about 48% from the Tuesday close.

TeraWulf

Shares of bitcoin miner TeraWulf (WULF) rose 103% in 2025 and have gained more than 40% since the start of 2026. By early 2026, the company’s total energy base had increased to 2.8 GW following the acquisition of two industrial sites in Kentucky and Maryland. According to Needham, TeraWulf is in discussions with investment-grade hyperscalers and is exploring potential projects with Fluidstack and Google. Company executives have not disclosed details but have indicated the possibility of leasing capacity to a major AI customer.

In the third quarter of 2025, TeraWulf generated recurring revenue from HPC capacity leasing for the first time, at $7.2 million out of total quarterly revenue of $50.6 million, an 87% year-over-year increase. Thanks to low power costs of about $0.04-0.06 per kWh, the company remains profitable even amid bitcoin volatility. In the third quarter, the cash cost of mining one bitcoin was $44,729 with an average realized price of $115,053, or 38.9%. The GAAP net loss of $455.1 million was driven not by operating performance but by noncash revaluations of derivatives and warrants linked to market conditions. On metrics that better reflect current operations, performance was stronger: adjusted EBITDA increased 202.8% year over year to $18.1 million.

In February, Needham assigned a “buy” rating to TeraWulf shares with a $21 per share target price, citing the monetization potential of an additional 1.5 GW of capacity and the expected near-term boost from leasing that. It views the company as well positioned to repurpose capacity for HPC workloads. The stock has 14 “buy” ratings from Wall Street analysts and an average target price of $23.17 per share, implying upside of about 43%.

Hut 8

Hut 8 (HUT) more than doubled its market capitalization last year, with shares gaining another 15% since the start of 2026. The company ranks among the 10 largest holders of mined bitcoin. In 2025, it made a strategic shift by commercializing its infrastructure assets. A key milestone was the December award of a 15-year contract with Fluidstack for 245 MW of computing capacity at its River Bend campus in Louisiana. The deal is valued at $7 billion, with potential to increase to $17.7 billion upon renewal. Google is providing a financial backstop, covering obligations for the 15-year base lease term. Hut 8 shares surged on the day the deal was announced on December 17, and analysts highlighted a structural transformation of the business.

The River Bend deal has broader implications: Google’s involvement and the potential expansion of the project beyond 1 GW create potential additional value, according to Roth Capital. The company is increasingly seen as a large data-center operator with long-term contracts and partnerships with global technology groups. Roth Capital has raised its target price on the stock to $80 per share, implying potential upside of nearly 50% from current levels.

At the same time, Hut 8 continues mining operations. After merging with US Bitcoin Corp., the combined hashrate reached 25 EH/s, among the highest in North America, while the company also operates commercial data centers in Canada, ensuring diversification. According to MarketWatch data, all 16 Hut 8 analyst ratings on Wall Street are “buy.” The average target price is $69.80 per share, implying upside of nearly 32%.

2026 outlook

In January, mining stocks continued to rise despite weaker bitcoin performance. According to JPMorgan, the combined market capitalization of 14 U.S.-listed miners increased 23% over the month to $60 billion, with 12 of the names outperforming bitcoin. The gains were driven partly by severe winter storms in the U.S. that forced some operators to curtail capacity and led to a reduction global computing power by about 6%.

This temporarily improved industry economics, with JPMorgan estimating mining profitability increased 24% in January from December. As a result, mining equities in January outperformed both bitcoin and the broader market. Profitability, however, remains below pre-halving levels. Early 2026 points to a shift in investor sentiment: miners are increasingly viewed as operators of digital infrastructure rather than purely crypto-market participants.

According to CoinShares, diversification into AI and cloud services is not weakening the bitcoin network. Aggregate computing power continues to reach new highs, underscoring the sector’s resilience and ability to adapt. This trend is likely to persist as operators seek to monetize rising demand for computing capacity while managing costs. The sector enters 2026 with strong momentum. Current valuations suggest companies combining mining with AI infrastructure are best positioned for further growth.