"Europe's 'Magnificent Seven': a response to US tech giants

According to Morning Star, the European tech sector, compared to U.S. tech giants in 2025, remained closer to a fair valuation and did not look as overheated / Photo: Milan Stock Exchange - Emanuele Cremaschi/Getty Images

Headlines about global stock markets today are now mostly shaped around a small group of US tech giants, which often makes Europe look fragmented, cyclical and slow to innovate. This view does not reflect the whole picture, says Francesco Bergamini, head of Freedom24 Italy.

The dawn of Europe

Europe's leading companies may be less visible, but they operate at the heart of the global economy. They control critical industrial bottlenecks, have sustained brand strength, and are driving long-term growth in the semiconductor segment as well as the healthcare, electrification, energy, and financial sectors. Their strength is in intellectual property, depth of engineering expertise and regulatory positioning - advantages that persist regardless of the phase of the cycle.

It is these qualities that help explain why European champions often trade at more conservative multiples than their U.S. counterparts, even as their strategic importance grows. Cash flows tend to be more stable, balance sheets are more resilient, and the risks of disruptive change are spread in their favor.

Together, these seven stocks clearly form Europe's answer to America's "Magnificent Seven": less momentum-oriented, more reliance on real assets, and deeply embedded in global supply chains.

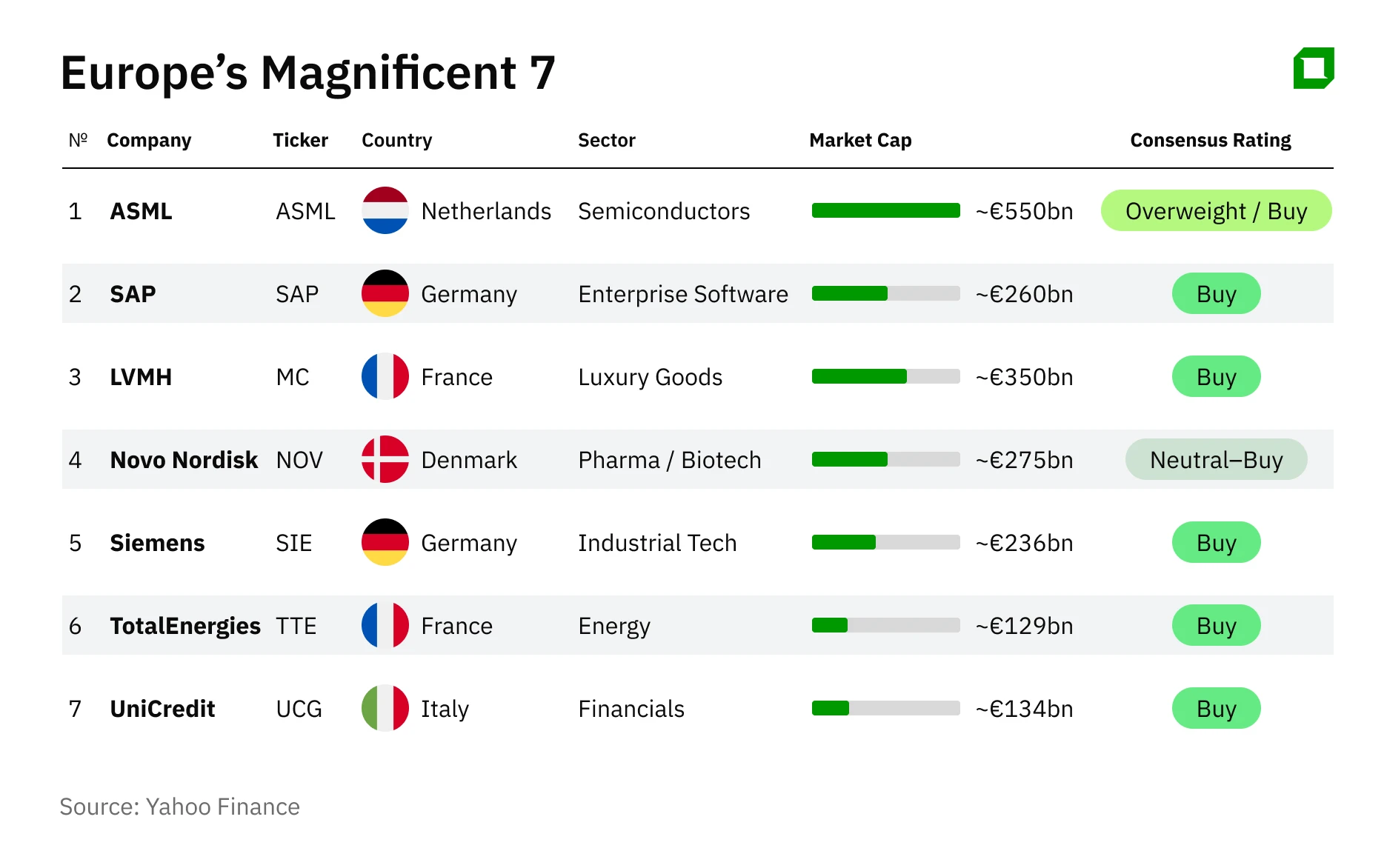

The table below shows Europe's Magnificent Seven, the sectors they dominate and how the market today views their prospects.

ASML (Netherlands) - the strategic jewel in the crown of Europe

ASML has an unrivaled strategic position in the global semiconductor industry. The company is the world's only commercial manufacturer of lithography machines using EUV technology - Extreme Ultraviolet [Ultraviolet radiation at the edge of the X-ray spectrum - Oninvest note]. EUV lithography is considered a critical element for the production of advanced chips for AI, data centers and high-performance computing.

The company directly benefited from the AI investment boom. Order volume rebounded sharply in the second half of 2025, and management has announced long-term revenue targets of up to €60 billion by the end of the decade. Margins remain among the highest in the global industrial technology industry.

ASML reported record orders of €13.2 billion in Q4 2025, well above analysts' expectations, on the back of sustained AI-related capital expenditure. The company forecasts revenue of €34-39 billion in 2026 versus €32.7 billion in 2025, supported by strong demand from leading contract chipmakers. Gross margins are expected to remain high, with long-term targets of 56-60% by 2030. A €12bn share buyback program and a 17% dividend hike reinforce returns to shareholders.

The consensus of analysts remains extremely positive: ASML is seen as a long-term growth asset with geopolitical protection due to export restrictions. According to MarketsandMarkets forecast, the EUV lithography market will almost double by 2032 and grow from $15.84 billion to $30.36 billion at a compound annual growth rate of 11.4%.

SAP (Germany) - a story of revaluation through the cloud

SAP has once again become Europe's leading publicly traded technology group after successfully transitioning to a cloud-based software subscription model. This shift has made earnings more predictable and supported rising multiples, allowing the stock to outperform European indices over the past two years.

In 2025, cloud revenue is expected to reach €21.6-21.9 billion (with total revenue of around €37-38 billion and operating profit in the range of €10.3-€10.6 billion). Analysts forecast medium-term growth - revenue could rise by 10-11% to €41.4bn next year and earnings per share by around 18% on the back of higher margin cloud revenues. In the medium term, independent forecasts suggest earnings growth of around 13-14% a year and revenue growth of around 10-11% a year, with a return on equity of around 18% in three years' time. SAP's cloud orders grew significantly, emphasizing the resilience of the business amid macroeconomic uncertainty.

Analysts generally expect steady earnings growth rather than explosive upside.

LVMH (France) - a titan of the luxury industry

LVMH remains the world's largest luxury goods group, with revenues in 2025 of €80.8 billion and operating profit from recurring operations of around €17.8 billion, reflecting solid margins despite weakening global demand. Free cash flow remained strong at around €11bn, supporting dividends and balance sheet flexibility. Although growth has slowed from post-pandemic peaks, the group continues to benefit from exceptional pricing power, particularly in Fashion & Leather Goods, its most profitable segment.

By region, performance was mixed, with the US and Europe showing relative resilience, while Asia - especially China - remained weak. Management is cautious about 2026, prioritizing brand investment and margin discipline over volume growth.

Analysts expect a gradual recovery from 2026, with organic revenue growth in the low single digits and moderate margin expansion as consumer demand normalizes. LVMH has shifted from being a momentum stock (i.e. growing by inertia - Oninvest note) to a quality "compounder" - less exalted but still structurally dominant.

Novo Nordisk (Denmark) - growth and volatility

Novo Nordisk remains one of Europe's most important healthcare companies, with strong leadership in diabetes and obesity, categories where strong structural demand remains amid an aging population and rising prevalence of metabolic diseases. In 2025, the company reported revenues of around DKK 309.1 billion and an operating margin of 41.3%, underscoring its exceptional ability to generate cash flow and industry-leading return on capital.

While the share price has corrected from previous highs - partly due to investor caution over next-generation drug results - the fundamentals remain compelling. Conversion to free cash flow is strong, supporting a growing dividend (current yield of about 1.5-2%) and share repurchase programs. Balance sheet metrics remain strong, with a conservative debt load by global pharma standards and sufficient capacity to fund R&D and point acquisitions.

We continue to project double-digit earnings growth in the medium term, driven by market share gains in GLP-1 and related therapies, as well as entry into neighboring therapeutic areas. Consensus forecasts suggest EPS growth of 10-15% per annum over the next two to three years, even taking into account the recent weakening of clinical catalysts.

A world-class healthcare company with structural demand, enviable margins and strong cash flows - short-term volatility does not cancel out a long-term growth trajectory.

Siemens (Germany) - the industrial backbone of Europe

Siemens remains Europe's leading industrial-technology group, with revenues in 2025 at €78.9 billion. Free cash flow remains strong, allowing for dividend payments and targeted share buybacks, with moderate net debt levels maintaining balance sheet flexibility.

Despite cyclical weakness in several industrial segments, demand for factory automation, industrial IoT and smart grids is supporting mid-single digit revenue growth and gradual margin expansion in the coming years. We forecast EPS growth of 5-8% per annum through 2027, underpinned by structural trends in automation and energy-efficient infrastructure.

From a balance sheet perspective, Siemens has moderate net debt relative to EBITDA, which maintains financial flexibility even as it invests in long-term growth areas such as the digitalization of manufacturing, smart grids and sustainable infrastructure. The shift toward software-oriented industrial products continues to improve the quality of revenue, raising the share of services and software to more than 40% of total sales.

Siemens combines solid fundamentals, strong cash flow and exposure to long-term industrial growth drivers, making the company a core structural asset of the European industrial economy.

TotalEnergies (France) - cash flow and transition

TotalEnergies remains one of Europe's largest integrated energy companies, combining a traditional oil and gas business with a steadily expanding low-carbon portfolio. Revenue for 9M 2025 was $136.4 billion and operating cash flow of around $16.9 billion, providing a dividend yield in the high single digits (around 5-6%). Strong free cash flow has allowed us to steadily return capital to shareholders through dividends and share buybacks, while funding growth in LNG, solar and wind power.

Diversified profit sharing has been key: LNG and renewables now contribute significantly alongside oil production, reducing net dependence on commodity prices. Disciplined capital allocation - including a commitment to reduce carbon intensity over time - attracts investors looking for both income and participation in the energy transition.

Analysts generally forecast moderate earnings growth in 2026-27, supported by LNG demand and improving economics of RE projects. Consensus models suggest more stable cash flows even with a moderate decline in oil prices, and most broker recommendations are at Buy/Outperform levels with upside targets from current levels.

TotalEnergies combines strong cash generation, attractive earnings and compelling positioning in the energy transition - a rare combination of resilience and forward momentum among European energy stocks.

UniCredit (Italy) - strong sector momentum

UniCredit has become not only Italy's leading financial institution but also one of Europe's most attractive banking stories, combining high profitability, strong capital and growing business scale. For FY 2024, the group recorded record net income of €9.7bn, slightly higher than the previous year, on the back of diversified revenues - including net interest income of around €14.4bn and fee and commission income of around €8.1bn - and a cost-to-income ratio of around 38%, highlighting operational efficiency. Return on tangible equity (RoTE) reached 17.7% in 2024, or over 20% with a CET1 ratio of 13% - strong for European banks.

A successful start to 2025 supported the momentum, with net profit for the first half of 2025 at around €6.1bn, including €3.3bn in the second quarter, and the bank raised its outlook for the year, expecting net profit of around €10.5bn and RoTE of around 20%. UniCredit also reiterated ambitions to achieve a net profit of at least €11bn by 2027 as part of a multi-year strategy supported by sustainable capital generation and the distribution of €30bn to shareholders in 2025-27.

Asset quality remains strong, with a gross problem asset ratio (NPE) of around 2.6% and low cost of risk, while capital ratios (CET1 of around 16% pro forma) reflect resilience relative to eurozone banks. A diversified presence in Western, Central and Eastern Europe, combined with a disciplined balance sheet and expanding fee business, supports expectations of further growth.

UniCredit combines European scale with growing profitability and shareholder returns, offering both a defensive profile typical of banks and compelling medium-term growth backed by strategic execution.

Europe as a market for strategic assets

Europe's "Magnificent Seven" may be second to Silicon Valley in terms of loud headlines, but they offer something arguably more sustainable: leadership in critical industries, iconic global brands, sustainable cash flows, and exposure to long-term structural growth trends. From advanced semiconductors and enterprise software to luxury, healthcare, industrial automation and energy transition, these companies combine scale, innovation and strategic influence around the world.

For investors, their appeal lies not only in their stability, but also in their sustained growth underpinned by strong fundamentals. Europe's corporate champions are well positioned to benefit from technological shifts, electrification, rising healthcare demand and expanding premium markets. In a world increasingly focused on sustainability and long-term value creation, these seven companies demonstrate that Europe can offer both credibility and opportunity, proving that its market leaders are not just stable - they are strategically relevant and poised for continued growth.

This article was AI-translated and verified by a human editor