Freedom Broker has put out a short-term trade idea to buy D-Wave Quantum, a maker of quantum computing systems, ahead of its earnings today, August 7. D-Wave's market value has already doubled this year, but Wall Street still sees room to grow further.

Details

Investors should keep a close eye on D-Wave shares ahead of the company’s second-quarter earnings, Freedom Broker said in trade idea note seen by Oninvest. The quantum computing firm is to report results today, August 7, before the market opens. Analysts are looking for updates on the rollout of D-Wave’s Advantage2 quantum system and expansion of its customer base.

D-Wave shares have historically shown significant volatility around earnings announcements, Freedom Broker noted. Following its first-quarter results, the stock surged more than 50% after the company posted a 509% year-over-year jump in revenue, beating Wall Street top-line estimates by 30%.

Amid sustained investor interest in quantum, Freedom Broker expects shares to rise again following the August 7 earnings release. The firm has set a two-month target price of $22.50 per share, implying 28% upside from the closing price yesterday, August 6.

Ten Wall Street analysts currently cover the stock, all with "buy" ratings, according to MarketWatch. The average target price stands at $20.10 per share, implying 14% upside to current quotes.

About the company

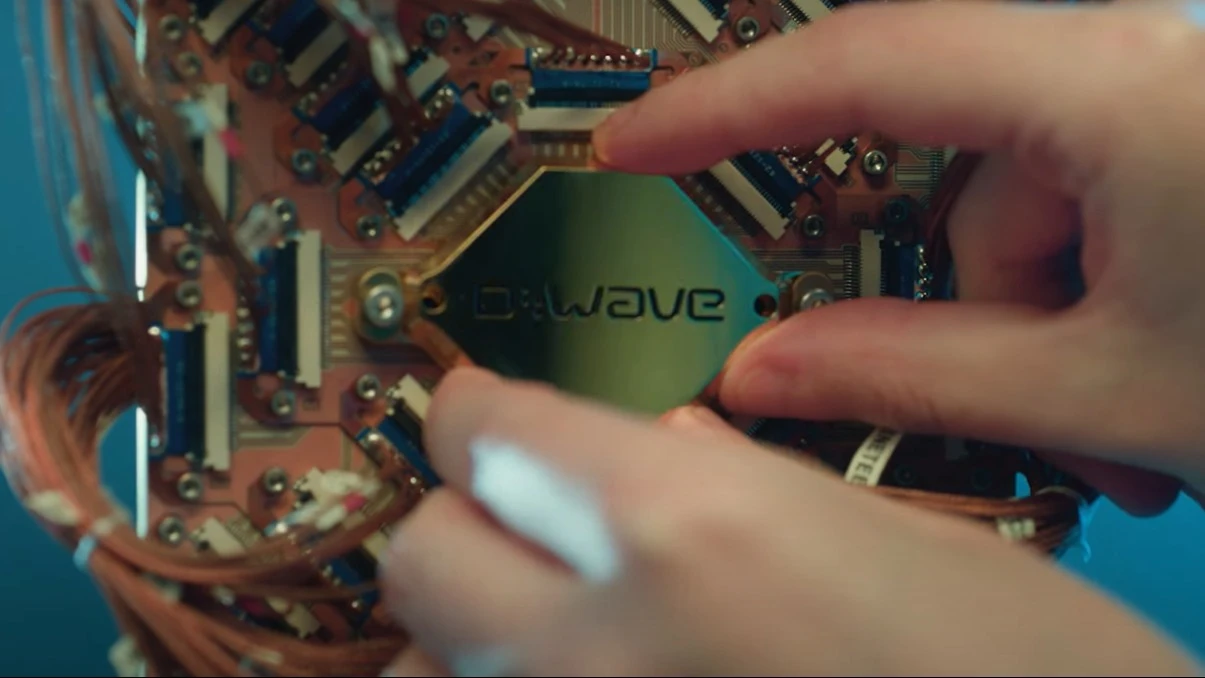

D-Wave Quantum develops quantum computing systems and software, and is considered a pioneer in quantum annealing – a technology designed to enhance computational performance, writes the Motley Fool. The company is also among the few players in the industry with operational quantum computers and real-world use cases across multiple sectors, the Freedom Broker report noted. Its customer base includes Japan’s largest telecom operator, NTT Docomo, and Canadian grocery chain Pattison Food Group.

In early March, D-Wave published a paper in the journal Science claiming that its Advantage2 system solved a problem in 20 minutes that would take one of the world’s most powerful supercomputers, Hewlett Packard Enterprise’s Frontier, nearly 1 million years to complete. In May, D-Wave began sales of the Advantage2; in one day, D-Wave shares gained 26%.

Context

Over the past year, there has been a lot of buzz around quantum. In January, Nvidia CEO Jensen Huang said getting “very useful quantum computers” to market could take 15 to 30 years. This caused a plunge in the share prices of segment players. Two months later, at Nvidia's GTC conference, Huang admitted he was wrong and said "I didn’t know they were public! How could a quantum computer company be public?"

Around the same time, Peter Chapman, chair of quantum computing hardware and software company IonQ, predicted, in an interview with the Investor's Business Daily, a "ChatGPT moment" for quantum. "If I was Sam Altman five years ago, would I have spent even any energy trying to convince the world that AI is coming?" he said. "You could have had Sam Altman buck naked on a corner street in San Francisco with a sandwich board saying AI is coming and no one would have listened."

Microsoft CEO Satya Nadella is also a believer in the future of quantum computing. Speaking on Microsoft's earnings call at the end of July, he said "the next big accelerator in cloud will be quantum."

The AI translation of this story was reviewed by a human editor.