Motley Fool: 'Most risk-tolerant investors' should consider buying Rigetti on the dip

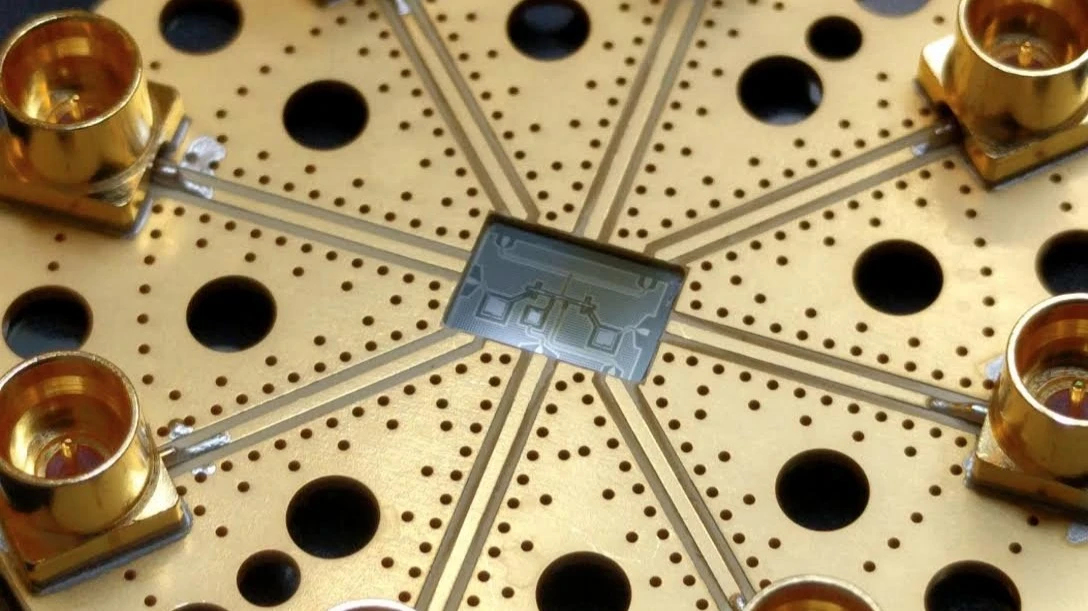

A Motley Fool analyst says buy Rigetti on the dip / Photo: X / Rigetti

Now may be a good entry point for shares of quantum computing developer Rigetti, Motley Fool contributor John Bromels argues. The stock is trading nearly 62% below last year’s high, he notes, but only risk-tolerant investors should consider investing in it.

Details

Rigetti’s stock has given back its 2025 gains and is trading more than 60% below its 2025 high, Bromels notes.

On Friday, February 6, Rigetti shares rose 18.3% to $17.71 apiece despite an absence of company news. The Motley Fool attributed the move to a broader rebound in the tech sector after several days of heavy selling.

In early trading on Monday, Rigetti shares have given back 2.8%.

Risks

Rigetti operates in the nascent quantum computing market and competes not only with similar startups, but also with tech giants such as Alphabet and IBM, Bromels writes. Companies in the sector are trying to optimize their systems across three parameters: speed, accuracy, and scale.

Rigetti’s quantum systems stand out for their speed but lag some peers in accuracy, the analyst notes. He compares them with those of startup IonQ, which are more accurate but slower. Rigetti says it is working to improve the performance of its machines, though it remains unclear whether it will ultimately outperform peers.

All this means the company is currently “too speculative,” so only the most risk-tolerant investors should consider buying the stock, Bromels cautions. He suggests taking a small position in Rigetti alongside other quantum computing stocks, or gaining exposure through ETFs focused on the sector.

What other analysts say

Wall Street is generally sanguine on Rigetti’s prospects as a stock: it carries 10 “buy” recommendations versus one "neutral" rating, according to MarketWatch data. The average target price of $40.30 per share is about 2.3 times the closing price on Friday.