Power-systems maker Vicor soars on strong, AI-boosted earnings and analyst upgrades

Quotes of Vicor Corporation, which makes modular power components and complete power systems, jumped 30% yesterday, October 22, after the company reported quarterly results that beat Wall Street expectations. The earnings prompted several analysts to raise their recommendations on the stock.

Details

Vicor shares yesterday rose more than 30% to $85.80 per share, a more than two-year high. As a result, the company’s market capitalization reached $3.85 billion.

Late the night before, the company reported that third-quarter revenue rose 18.5% year over year to $110 million, roughly 16% above the Wall Street consensus, the Motley Fool noted. Earnings per share jumped 142% to $0.63. That figure was also far ahead of expectations, the outlet wrote.

What's next

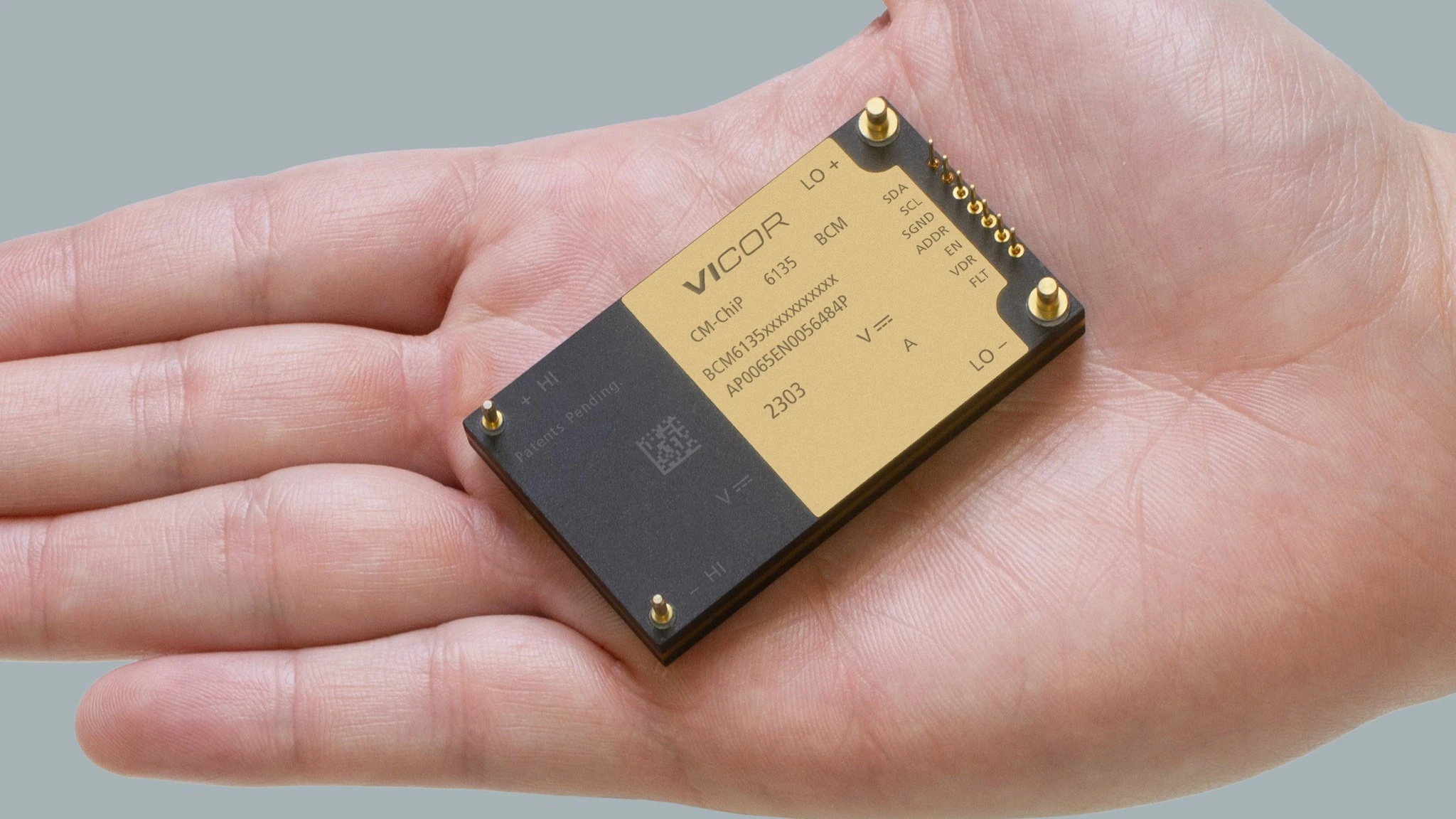

Vicor has developed a power-delivery architecture designed to meet surging energy demand from AI data centers, Barron’s wrote. On the earnings call, the management said the company’s latest-generation power-delivery solution is slated to launch in 2026. The company is currently in talks with potential customers, including a large data-center operator and several chip makers, though the names were not disclosed.

Barron’s also noted that the AI data-center build-out bodes well for Vicor’s licensing business, which receives royalties for licensing patented technology to customers, including bus converters and vertical power-delivery systems that improve energy efficiency. The company forecasts its licensing business can expand from its current $90 million annual revenue run rate to $200 million in the next two years (for 122% growth), CEO Patrizio Vinciarelli said on the call. For comparison, licensing revenue grew 62% year over year to $21.7 million in the third quarter.

What analysts say

The strength of the licensing business led Needham to upgrade Vicor from “hold” to “buy.” As more data centers adopt vertical-power solutions, the company has an opening to secure new licensing agreements, analysts said, according to Barron’s.

Craig-Hallum followed by upgrading Vicor from “hold” to “buy” and raised its target price by 64% to $90 per share, for about 5% upside versus the last close.

Vicor has a total of three recommendations from Wall Street analysts and all are “buy,” according to MarketWatch. The average target price is $86.67 per share, about 1% above the October 22 close.

The AI translation of this story was reviewed by a human editor.