Shares of tiny Raspberry Pi soar on X post that AI agents could drive demand

Raspberry Pi shares soared on an X post / Photo: y0ye / Shutterstock

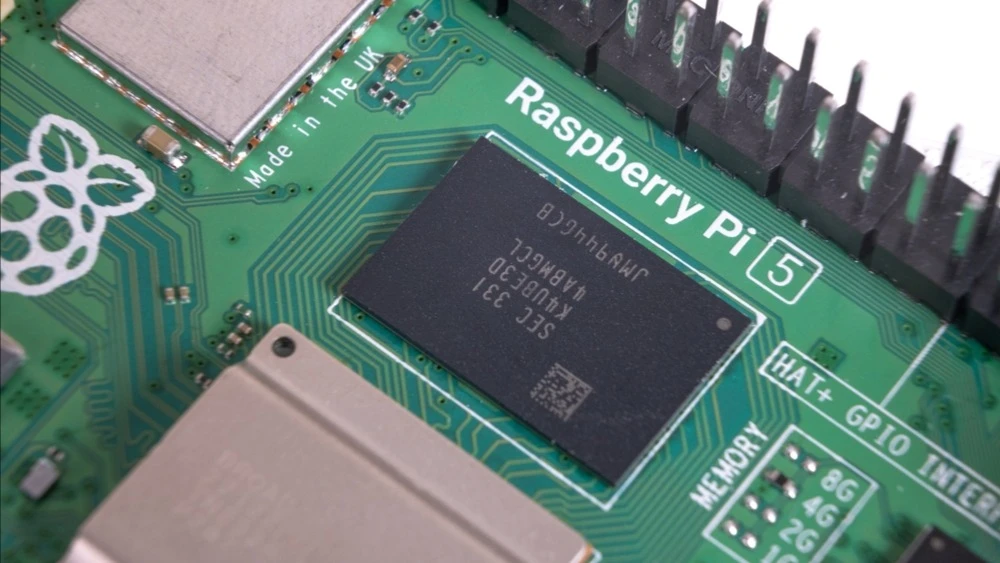

Shares of British Raspberry Pi, the maker of some of the simplest personal computers, surged about 25% in the first minutes of trading on the London Stock Exchange on Tuesday. The move followed a post on X suggesting that AI agents such as OpenClaw could boost demand for Raspberry Pi single-board computers as an alternative to Apple devices.

Details

Shares of Raspberry Pi Holdings jumped 25% on Tuesday in the half hour after the opening bell on the London Stock Exchange. At the time of this writing, the stock was up 28%.

The advance extended a rally that began on Monday – when the shares jumped 43%. That marked the biggest intraday gain since the IPO in June 2024, Bloomberg reported.

Stock performance

The catalyst for the rally was a post on X by a user named Serenity with 58,500 followers. The post suggested that AI agents such as OpenClaw could drive demand for Raspberry Pi single-board computers. “

Feels like markets haven't priced this,” the post read. By Tuesday, it had attracted more than 312,000 views.

OpenClaw has gained a cult following since launching in November, thanks to its ability to operate autonomously and handle tasks such as clearing inboxes, making restaurant reservations, and checking in for flights, Bloomberg wrote. While many desktops and cloud servers can deploy the tool, users often prefer to run it on separate devices such as an Apple Mac Mini or a Raspberry Pi due to potential security risks.

That said, the company's PCs are significantly cheaper, priced at $20 to $200 versus Apple's $500, according to the X post.

In the first half of 2025, Raspberry Pi revenue fell 6% to $135.5 million. The author of the post said the figure should rise as buyers purchase dozens or hundreds of devices to run AI agents. Analysts currently project revenue growth of 14-17%, though it could accelerate to 48-55% if hoarding continues, the post said.

The social media attention underscores the potential for Raspberry Pi to become an essential platform for processing AI workflows on local devices, Montanaro Asset Management fund manager Adam Montanaro (he owns shares in the company) told Bloomberg. “While the near-term growth estimates quoted by the blogger look optimistic, thematically the evolution of a Raspberry Pi from hobbyist board into a core piece of AI infrastructure is correct,” Montanaro said.

On MarketScreener, the stock has two “buy” ratings versus one “hold,” and the average target price remains below current quotes.