The cost of burnout: how sleep deprivation and everyday stress reduce investment returns

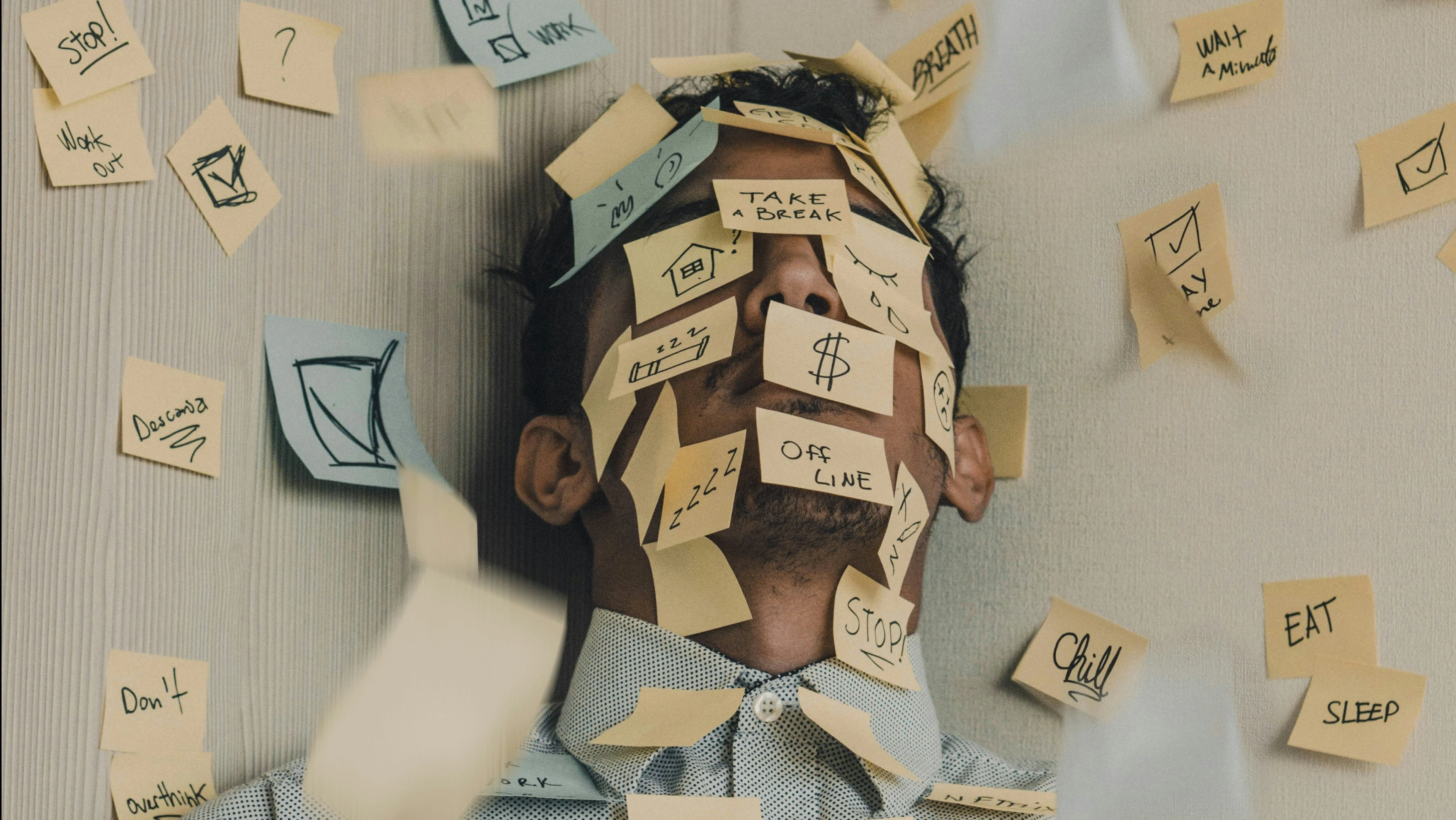

In the state of fatigue, the danger sensor is turned off: the brain continues to rejoice in profits, but stops reacting to losses. Photo: Luis Villasmil / Unsplash.com

Sleep-deprived people stop perceiving negative feedback, i.e. a losing trade no longer makes the tired person's brain adjust the investment strategy. At the same time, the brain switches to the energy-saving mode and starts using simplified thinking patterns. And although in the world of finance it is commonly believed that success depends on intelligence, in reality this is far from true. Let's see how fatigue not only makes us risky, but also inconsistent in our investments.

A tired brain is a bad investor

Despite its modest weight, the human brain "consumes" 20% of the body's energy. When energy is already low, when, for example, we haven't had enough sleep, or it's been a long day, the body switches on the austerity mode. First of all, the most "expensive" functions are switched off. One of them is a kind of office, where our inner Warren Buffett sits, responsible for logic.

When this "office" shuts down from fatigue, control shifts to other systems. What does this mean for the investment portfolio?

First, your brakes are failing: what seemed crazy in the morning looks like a rare chance at 11 p.m. against the backdrop of fatigue.

Secondly, there is an effect of insensitivity to pain: the brain continues to rejoice in profits, but stops reacting to losses. You see a trade going negative, but your danger sensor just doesn't light up. So it can happen that you stare at the screen and...do nothing.

This effect of insensitivity to pain is called "decision fatigue" - decision fatigue.

By the evening of the working day, and even more so by the end of the week, your resource may be exhausted. At this point, it is not your intellect that makes decisions, but your fatigue.

Sleep deprivation studies(2000 and 2023) show: the lack of adequate night's rest is comparable to alcohol intoxication: the ability to assess risk declines and the propensity to gamble increases. The brain is too busy trying to just "get to the pillow".

At the cognitive level, thought "stamps" are triggered, in other words, cognitive heuristics are when your brain takes a shortcut. The mechanism helps you make decisions quickly, but often erroneously. In the face of financial uncertainty - be it trade or political wars on Trump's part - heuristics are also misleading. For example, the Availability Heuristic means that the brain gives more weight to information that is easiest to recall. That is, if yesterday you read three articles about the dot-com crash, today you will perceive any slight decline in the market as the beginning of the crash.

In addition, we tend to judge the likelihood of an event by how similar it is to our perceptions - this is called the Representativeness Heuristic, and it often goes hand in hand with the Affect Heuristic. The latter is perhaps the most dangerous for the investor. This is "like-dislike" decision-making, i.e. emotional response replaces financial analysis - "I feel this way, so it's right".

When stress is costly

Stress is not always a bad thing. Psychologists divide it into distress (negative) and eustress (beneficial). In the latter case, a person perceives something not as a threat, but as a positive challenge. It turns out that a short burst of anxiety can be useful: it makes you double-check figures before a deal or look for an anomaly on a chart. In other words, it's just vigilance. Cognitive-behavioral psychologists are just talking about the benefits of "vigilance anxiety."

The problem starts when stress becomes chronic. It is sleep deprivation that turns useful vigilance into distress, and the brain begins to work according to the principle of "tunnel vision". The brain shuts down perception of peripheral information, meaning that in essence potentially important data may simply not come into the investor's field of vision. In practice, it is possible to feel and observe fixation on one detail, forgetting, for example, that in general, the rest of your portfolio is in the plus, although one index is declining.

From here you automatically ignore the context: in the "tunnel" you are unable to take into account many external factors - for example, that the Fed chief is speaking tomorrow or that Trump has just written a post about duties. For you, there is only the here and now. As a result, you lose flexibility and stop seeing not only incoming data, but also alternative solutions, combinations of options. This is a paradox: the investor himself begins to strive to lose.

How to maintain a resource: investment hygiene

If you want your decisions to be effective in the face of uncertainty, you need to invest not only in stocks, precious metals and other financial assets, but also in your own resources. Given that we're talking about fatigue and stress in this context, it makes sense to rely on self-made rules of thumb. Here are a couple of potentially useful ones.

No trades after 9 p.m., as self-control levels drop by evening. If an idea seems brilliant at midnight, write it down and reread it at 9am. A 2025 study in Behavioral Sciences confirms: sleep restores cognitive control, which is essential for risk assessment.

Fragmentation of decision-making: don't try to redesign your entire portfolio in one go if you are tired. Your energy and cognitive resource is limited. And research also confirms: willpower is also a finite resource.

Ask yourself: am I making a decision now because I've analyzed it, or because I'm tired and want to get it over with soon?

These principles can be not only a set of rules when you are already in a stressful situation, but also a checklist that anticipates your decisions before you even get into that situation.

And you can confidently put sleep on the same list. It's the process of rebalancing your neural network. During sleep, your brain converts short-term memory - the day's information - into long-term memory. And this allows you to learn from your mistakes. Otherwise, there is a risk that you will make the same miscalculation over and over again, simply because your brain has not had time to "evaluate" the past negative experience.

This article was AI-translated and verified by a human editor