The curse of September: how investors can survive the most dangerous month of the year

Given that September corrections are not uncommon, you have to consider your options of whether to short the Nasdaq Composite and Nvidia, buy put options on the S&P 500 index, or sell everything

There are lies, there are blatant lies, and there are statistics

The main question of September-2025: will investors dump big tech and technology companies in general, because the main "bubble" is there. We asked the AI: "How do big tech stocks in the Nasdaq Composite (capitalization of which exceeds $100 billion) usually behave in September, especially in years when the market is at all-time highs after months of growth?".

Analysts Alexei Golubovich and Alesander Orlov received the answer, corrected, supplemented and edited it.

The off-season

The ninth month of the year is historically the worst month for the entire market: S&P, Dow, Nasdaq. New highs in Big Tech, especially at record highs, were very rarely recorded.

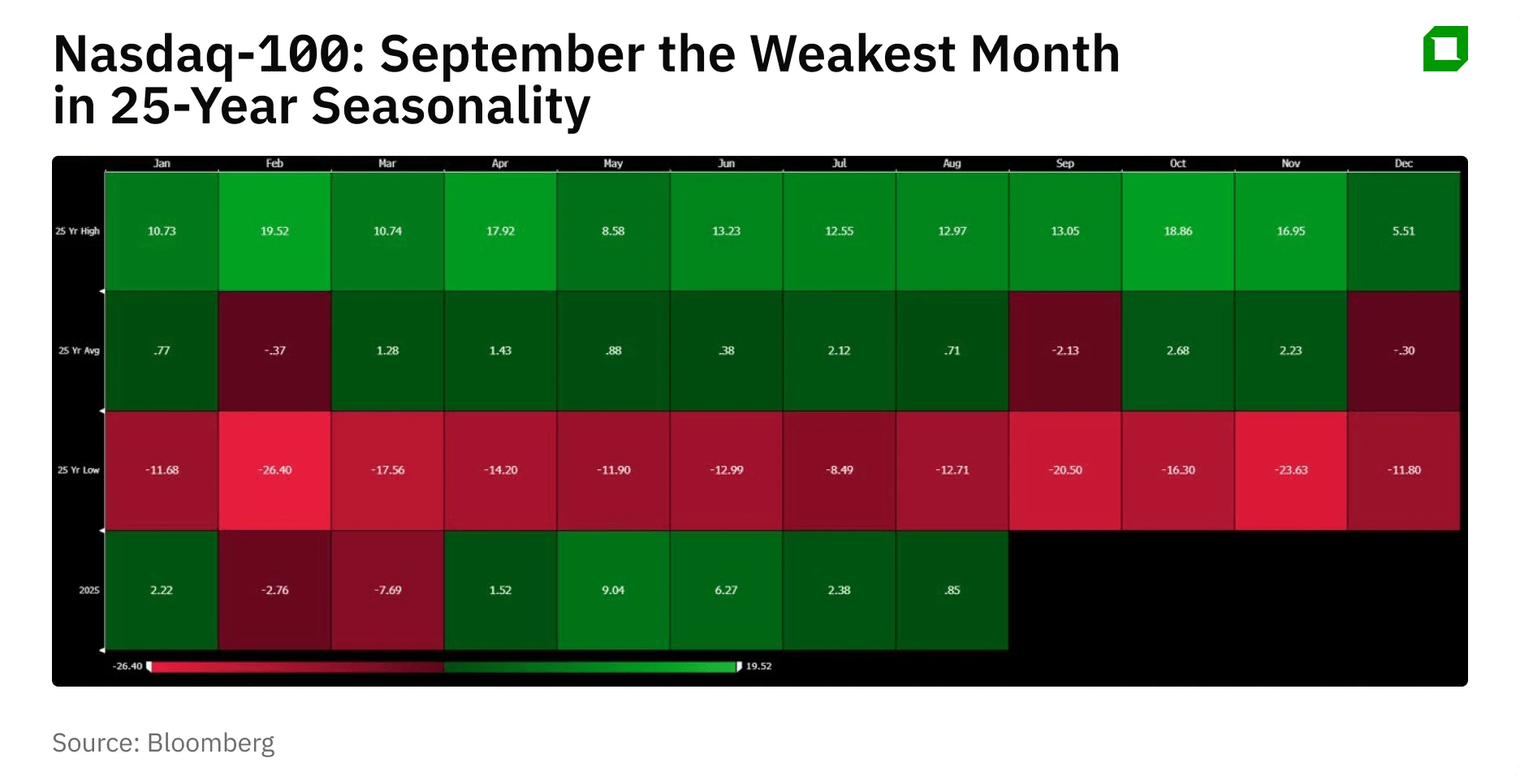

Moreover, for more than half a century - since the 1970s - the Nasdaq Composite's average September return is negative - about -0.9%. For the narrower Nasdaq-100 (which is about half of the top 10 tech stocks by capitalization) over the past quarter century, the statistics are similar - a very weak September before a late fall rally.

Techno-giants (companies with capitalization of $100 billion +) usually pull the market up, but in September they often become the leaders in profit taking by traders/investors, especially after a prolonged rally. If the market is at highs: after several months of growth, September often brings volatility and local pullbacks as investors "unload their portfolios" before the end of the quarter and tax optimizations.

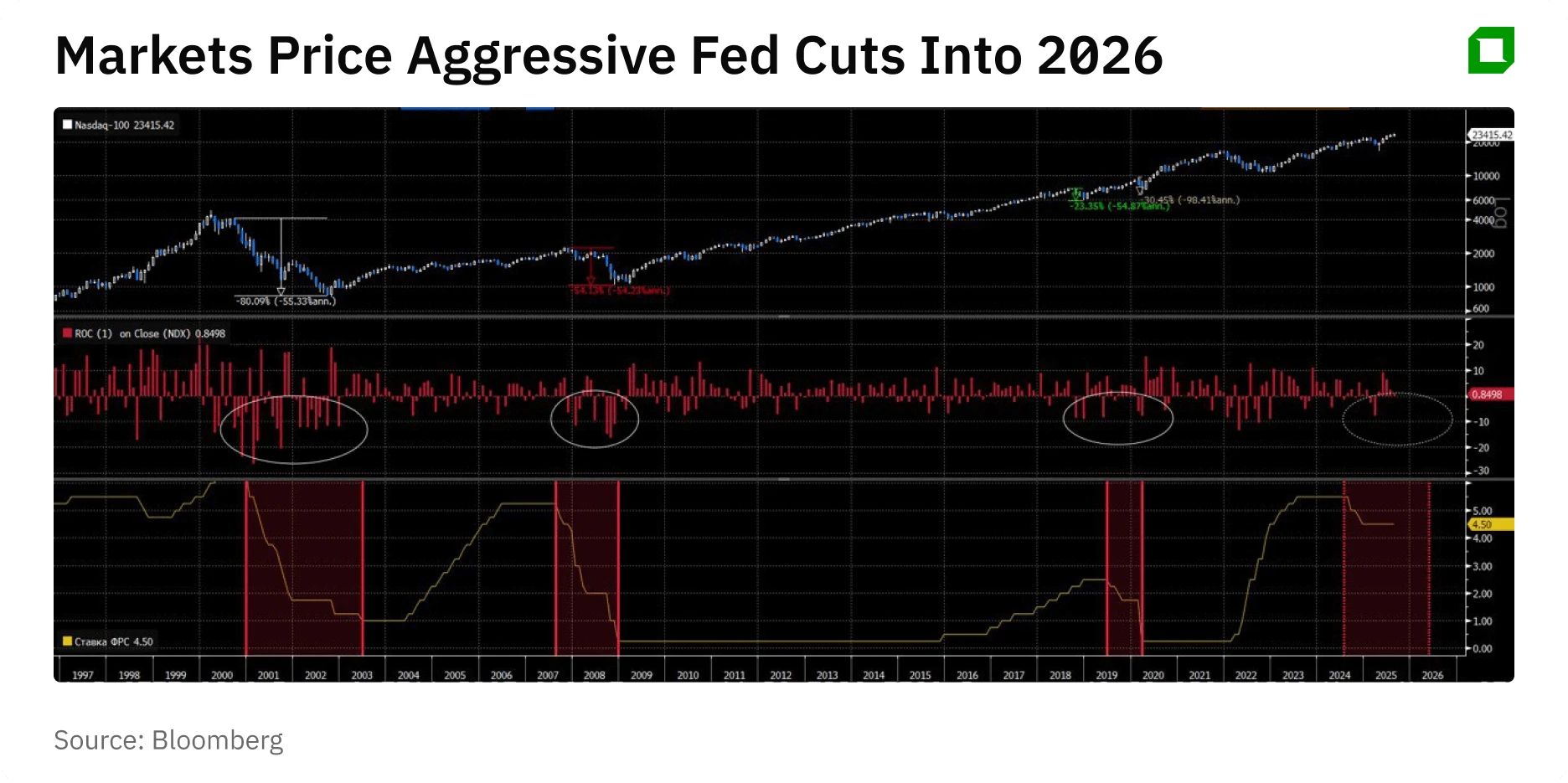

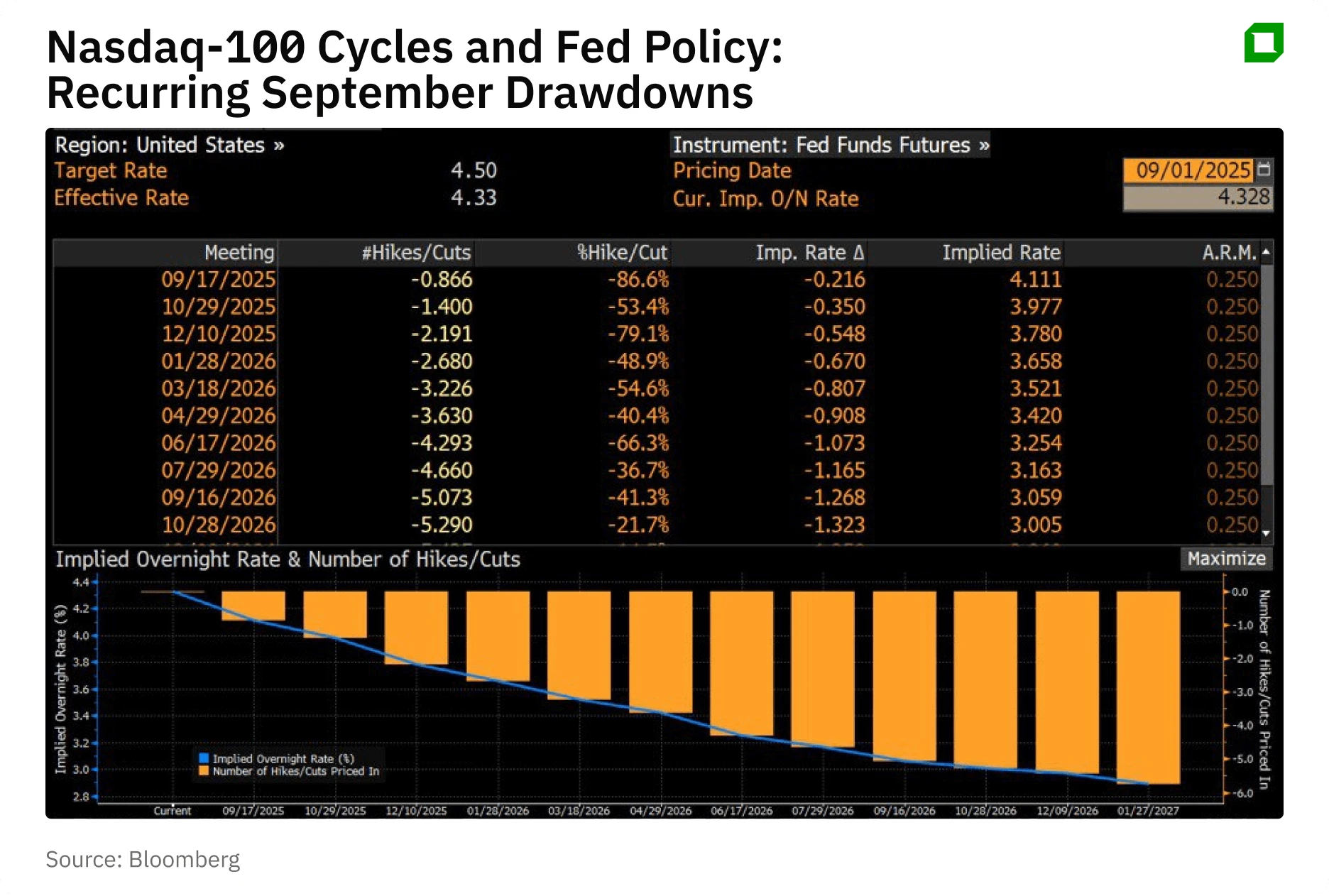

Factor in a reassessment of short-term macro forecasts - multiples for FAANGs (Facebook (Meta), Apple, Amazon, Netflix, Google (Alphabet)) - are often under pressure in September if investors expect geopolitics to worsen or weak macro statistics. But now they're waiting for a rate cut.... It seems that this should be good for stocks, but historically it has been the other way around: cycles of rate cuts are an indicator of weakness in the economy and a trigger for investors' funds to flow into protective assets - government bonds and precious metals. The dynamics of Nasdaq-100 becomes more volatile during periods of Fed rate cuts, and the main dips in quotations occur precisely during the rate cut cycle

Inflows / outflows into funds is another factor. September is the end of the fiscal year for many funds (especially in the U.S.), which encourages portfolio rebalancing. There may also be high volatility around the "triple expiration" of futures, options and swaps - the third Friday of September shows increased sales volumes.

And third, geopolitics and the Fed: Fed meetings in September have historically coincided with notable moves in the tech sector.

The score is 9-2 in favor of the reduction

What the data for September shows for the last 15 years, that is, since the beginning of the recovery from the 2008-2009 crisis.

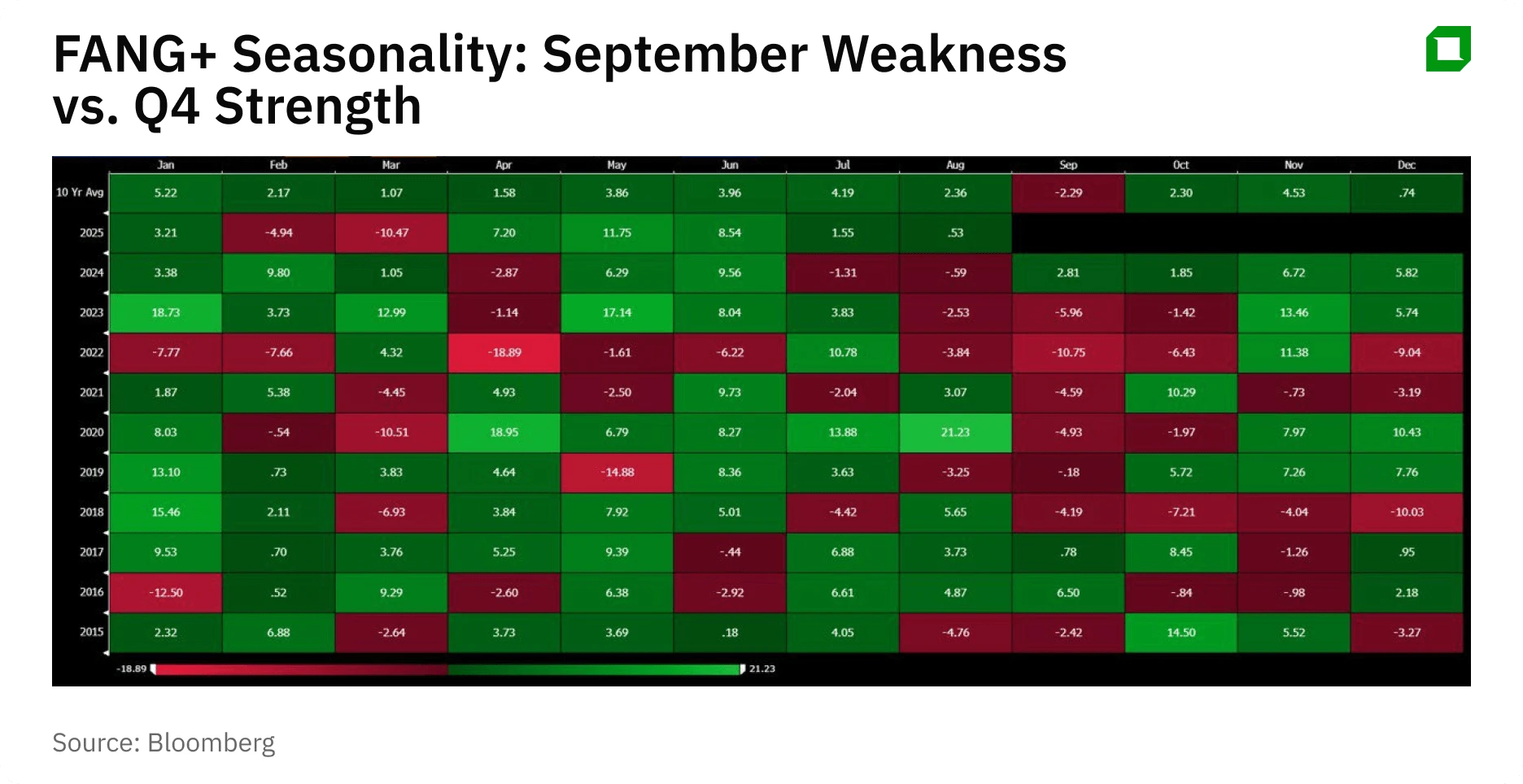

First, consider the FAANG basket. According to PortfoliosLab data, since 2014, 9 out of 11 Septembers have been negative. Exceptional was last year with a return of 3.69% and a record September in 2016 - plus 3.92%. The down years are far more dramatic - minus 12.4% in 2022 and a 9.38% drop in 2020. The average return in September is negative - minus 2.53% and the median is minus 1.46%.

And here's what the FAANG+ index monthly trend matrix looks like (plus Microsoft, Nvidia, Broadcom, and ServiceNow with CrowdStrike) - only 2016 had a good September, and 2024 not bad after a dip in July-August.

Second, the broad Nasdaq Composite has lost about -0.9% on average in September since the 1970s.

Why is September often volatile/corrective for Big Tech?

First, the return of traders and managers from vacations often leads to revision of portfolios and profit taking in rising stocks.

Second, the blackout of buyouts begins: in mid-September, as the reporting season approaches, many corporations go into a "quiet period" and corporate purchases temporarily decline. That is, there is an obvious weakening of market support for issuers during this period (although there is research that the effect is not always negative, but the market does not take this into account) - and after all, they collectively bring more than $1 trillion of fresh cachet to the market per year

And thirdly, the end of the fiscal year is the end of the US budget, which often results in liquidity shortages in the banking sector. Some large institutional investors (pension funds, insurance companies) also end their fiscal year in September. They are also rebalancing and "clearing" portfolios, in which the grown technology companies are over-leveraged positions

What's next: three scenarios for September and the rest of the year

Based on the current background: the market is at highs, by September 2025 futures are laying down a high probability of a Fed rate cut. The target range is now 4.25-4.50% and the market has already plotted a cut to 4.00-4.25% in September and then 4-5 more cuts in the next 12 months to below 3%. This is only possible if the economy slows down to the point of sliding into recession.

We believe that the probability of a bullish scenario is 10%. If the economy is strong and rates are stable, even September can produce growth. But more often it is accompanied by strong intra-month volatility.

Probability of neutral scenario with soft drawdown is 30%. With a moderate Fed rate cut in September, there will be short-term volatility amid blackout/expiration, but drawdowns are bought out. Then through the end of 2025, long-term investors in "safe" stocks benefit from lower yields. That said, Microsoft, Alphabet, Meta, and Amazon (i.e. cloud, advertising, and major AI services) are holding up better than the market. Other leaders like Apple are relying on service revenues and buybacks. Nvidia and some other semiconductor companies continue to benefit from increased investment (capex) in AI, although they are more sensitive to news on the supply chain and chip exports.

The risks lie in overvaluation, in the "growth - quality - value" rotation.

As a result: sideways movement with increased turbulence: growth/decline within the range, without trend change.

Ideas for realizing this scenario in a portfolio: hold "quality" in Big Tech, diluting the portfolio with QQQ (ETFs on the "equal-weighted" Nasdaq-100).

The probability of "bearish" scenario is 60%: standard development of events with profit taking on the largest companies (Nvidia), Nasdaq Composite down by 3-7% within a month (then recovery by October-November if there are no unexpectedly bad macro statistics). Bears' main hope: global recession due to slowing global demand growth.

The reasons are inflationary acceleration, which may cause a hawkish Fed reversal. The reaction to a rate cut in such a scenario is twofold: multiples are supported, but EPS risks dominate and Big Tech may sag worse than the index on reporting.

Then there will be an above-average correction in September, with a sell-off in cyclical and tech stocks.

Also in the fourth quarter of 2025, almost all of the "Magnificent Seven" may fall: Meta and Alphabet due to pressure on advertising budgets, Apple and Amazon remain vulnerable to fluctuations in consumer demand, Amazon also has a slowdown in the growth of the "cloud" business - as well as Microsoft. Market leader Nvidia and other semiconductor makers are at risk due to oversupply of orders and inventory buildup. But increased investment in AI will soften the blow.

If a bearish scenario strategy is adopted as a basis, it is advisable:

- Limit portfolio concentration in the Magnificent Seven, up to and including shorting them;

- balance the basket in portfolios by increasing the share of government bonds and other protective assets (gold, Japanese yen);

- hedge via put spreads for October-November (these months are statistically stronger than average). For example, you could buy a put on the S&P500 with an expiration date of September 30th and approximately the current strike (6400, -1% to the market) for less than 1%, and finance it by selling a put for November 21st, but with a strike of 6000 for the same 1%;

- buy volatility to the market as a whole:

1. through VIX/VXX instruments, but remember about contango in the futures curve (this is a situation when distant futures are more expensive than near futures), because of which it is necessary to accurately guess the moment of entry and do not sit in the position for more than 1-2 weeks);

2. by buying cheap put options with long strike. For example, a 6000 put on the S&P500 expiring on 30/09 costs a quarter of a percent. And if the market falls by only 4% with a corresponding increase in volatility, its price will grow six times in a week or so.

The redemption window opens after the third quarter reports, and this usually supports the market towards the end of the year. Therefore, the September drawdowns were usually good entries before the seasonal "Santa Claus rally". Although this seasonality with the New Year rally is only seen in periods of rising markets, and now there is every reason to believe that we are on the cusp of a long-term trend change to the downside - Trump's aggressive trade policy and the risks of inflation and debt crisis in the U.S. are increasingly relevant.

This article was AI-translated and verified by a human editor