How can you tell if a bubble has already formed in the market that could burst, or not yet? Checklist

Freedom analysts see signs of overheating in the AI market, but believe investors should not fear a sudden and painful bursting of the bubble.

Every second professional investor surveyed by Bank of America in November believes that a bubble has formed in the shares of companies involved in artificial intelligence. Forty-five percent called it the biggest extreme threat to global markets—a so-called tail risk, meaning a very rare event with devastating consequences.

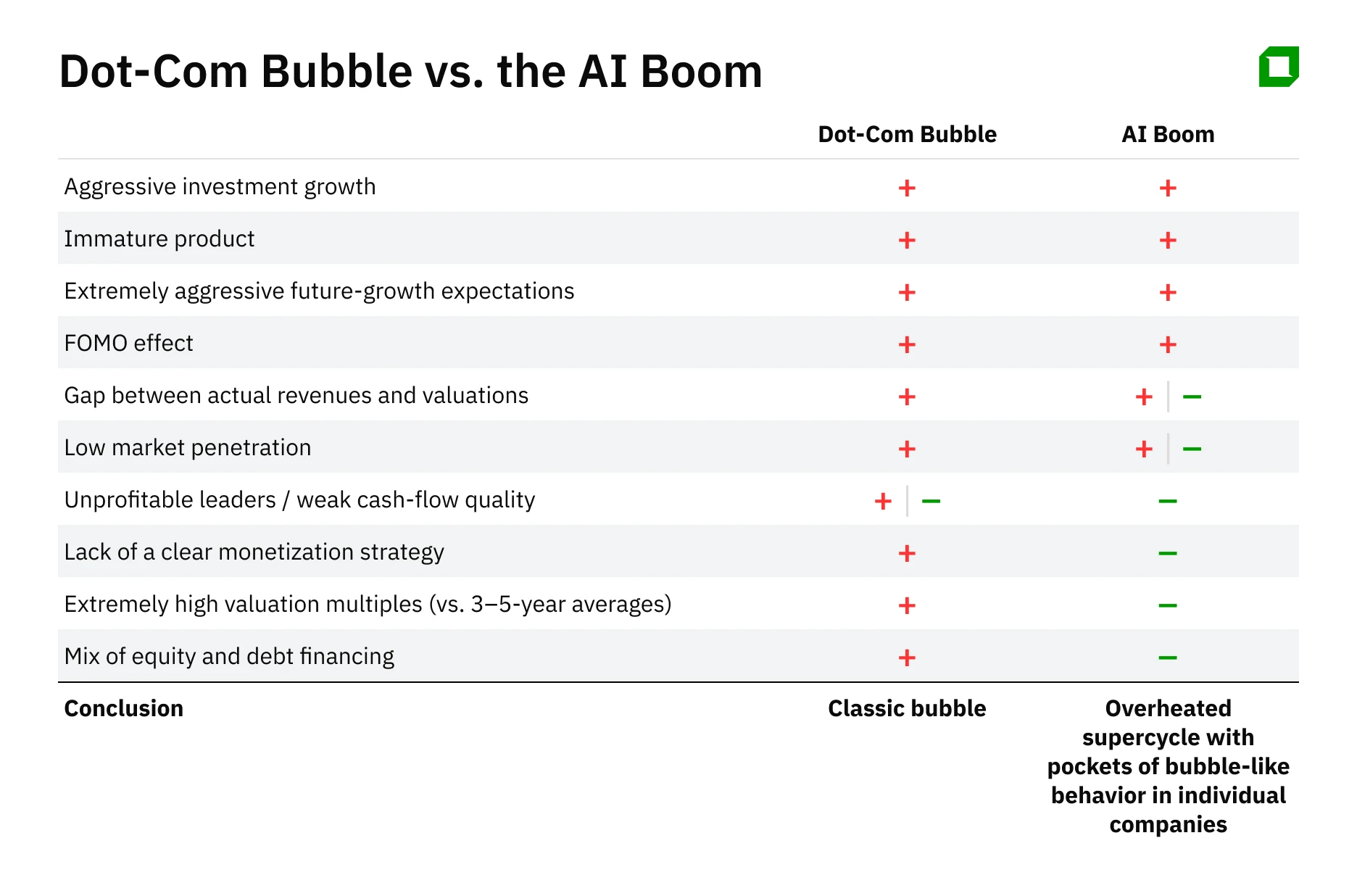

The AI boom does indeed have some signs of a classic bubble, but still, when compared to the dot-com era, it is not a bubble, writes Freedom Broker in its strategic review for 2026. Its analysts have compiled a checklist of signs of a dot-com bubble to compare it with the current situation.

— Like dot-com companies in the early days of the internet, AI developers are aggressively and steadily increasing their capital investments in infrastructure. Freedom notes that if we consider only large cloud companies (hyperscalers), their investments in equipment will reach a sum comparable to approximately 1.1% of GDP by the end of 2025. During another bubble — the railroad boom in the United States in the 19th century — investments in railroad construction reached, according to various estimates, 6–7% of GDP, analysts note.

— In terms of maturity and product penetration, the AI boom and the dot-com bubble are also similar, according to Freedom analysts. In 2000, 41% of households had internet access, while ChatGPT was used by about 34% of Americans as of June 2025. Although AI developers have made significant progress in chatbots, the mass adoption of AI in real products and services remains low, the review says.

— At the same time, from a monetization perspective, the current AI boom and the dot-com bubble are very different from each other, according to Freedom analysts. In the early 2000s, the internet and related products were just emerging, while AI is now already being used in one form or another by major companies (for example, for advertising targeting).

In addition, in 1999–2000, Internet startups, even with aggressive revenue growth, remained relatively small and predominantly promising issuers, analysts note. Today, OpenAI and Anthropic have shown exponential revenue growth over several years and could reach the same level of sales as the largest software developers in the US by the end of 2026, according to the review. This does not automatically solve the problem of unprofitability and dependence on investors, but it shows that AI leaders can monetize their products at a qualitatively different level than companies in the 2000s, Freedom notes.

— The situation with debt financing is also radically different — for telecom companies and Internet startups in the dot-com era, it was a significant source of financing, analysts note. At the same time, the dot-com bubble coincided with a decline in the availability of borrowing, and as a result, the liquidity shortage, among other things, contributed to the bursting of the bubble. The situation is now the opposite, thanks in part to the Fed's rate cut.

— Many now consider tech market valuations to be overpriced — a classic sign of a bubble, according to Freedom analysts. At the same time, they emphasize that, overall, the market and its largest companies are now valued significantly below the levels seen at the beginning of the century. In recent quarters, big tech valuations have stabilized: forward P/E ratios for Microsoft, Meta, and Amazon are roughly at their five-year averages, while those for Alphabet and Apple are closer to the upper end of their ranges, analysts note.

What's the outcome?

"We do not view the current cycle of investment in AI infrastructure and AI companies as a bubble that is bound to burst soon and painfully," analysts say. According to them, the rapid growth in revenue of the largest AI developers indicates that the technology is already generating real money and penetrating business much more deeply than in the dot-com era.

At the same time, analysts see signs of overheating due to overly active investment in AI. The market may feel the effects of these investments when they begin to be "digested," but without a sharp collapse, as is usually the case when bubbles burst, Freedom concludes.

This article was AI-translated and verified by a human editor