Social networks, fintech and chips: what the fund Dalio founded has added to its portfolio

Bridgewater's largest hedge fund also sharply increased its biggest bet - on the U.S. stock market

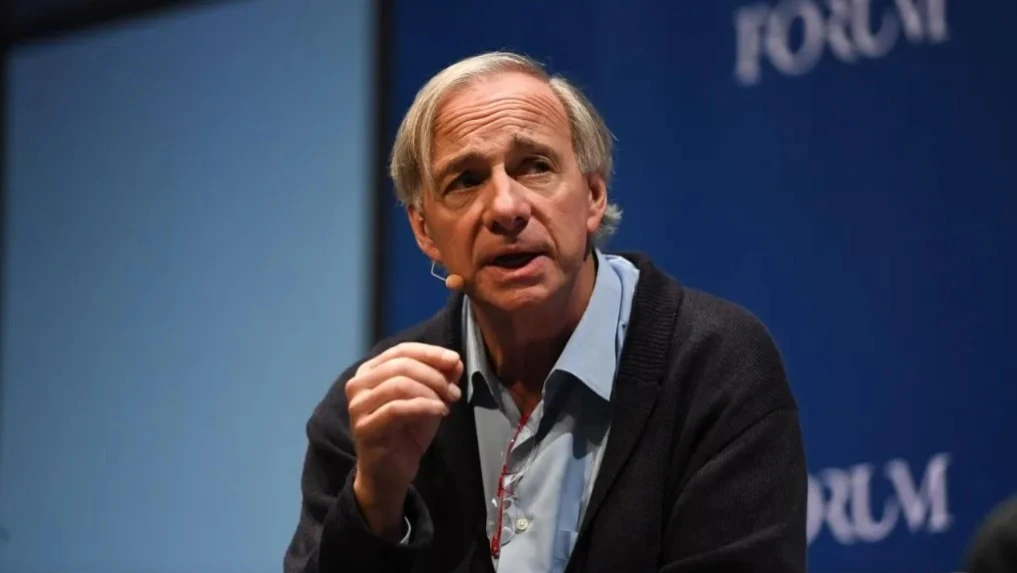

Bridgewater Associates, the largest hedge fund founded by Ray Dalio, made large bets on three new stocks in the third quarter - in the social networks, financial services and semiconductor equipment segments. It also boosted its underlying exposure to the U.S. market and cut stakes in companies whose securities had already risen strongly in value. The billionaire investor himself stepped down from Bridgewater's board this year, but has promised to serve as a mentor.

Details

Bridgewater added nearly 500 new stocks to its portfolio between July and September 2025. The most significant new acquisition was a stake in the social network Reddit. The fund bought 617,200 securities of the company for $142 million, which accounted for 0.6% of its portfolio, GuruFocus writes, citing Bridgewater's Form 13F report published on November 13.

The second largest addition is shares of Robinhood Markets, an operator of a platform for trading on stock and cryptocurrency markets. Dalio's fund bought about 807,500 Robinhood securities worth over $115 million. They took up 0.5% of Bridgewater's portfolio weight. Applied Materials, one of the key equipment suppliers to the semiconductor industry, rounded out the top three largest new positions with 463,500 shares worth $94.9 million (0.4% of the portfolio).

What else is important to know about fund transactions

Bridgewater has sharply increased its position in the iShares Core S&P 500 exchange-traded fund, which reflects the dynamics of the U.S. index of the same name. The fund bought about 1.74 million securities, increasing its stake by 75% - now this ETF occupies 10.6% of the portfolio and remains the largest position in it (at $2.7 billion). The stake in semiconductor equipment manufacturer Lam Research was doubled: the position grew to 3.46 million shares worth $464 million.

The hedge fund actually exited its broad emerging markets bet in the third quarter, reducing its position in the iShares Core MSCI Emerging Markets exchange-traded fund by 93%. It also cut its stake in Nvidia by 65%, from 7.2 million to 2.5 million shares ($468 million). Shares of the main beneficiary of the artificial intelligence boom rose 39% in the first three quarters of 2025.

Bridgewater closed a position in the SPDR Gold Shares exchange-traded fund, the dynamics of which follows the spot price of gold: the fund sold 1.1 million shares for $337 million. Dalio himself is a consistent supporter of investing in this precious metal, he calls it "the most reliable money" and suggests allocating 10-15% of the investment portfolio to it.

The fund also exited Spotify, selling all 284k shares for about $217 million. In total, it completely got rid of stakes in 65 companies during the quarter.

Portfolio core

By the end of the third quarter Bridgewater's portfolio included more than 1 thousand shares. However, its core is still betting on the growth of the U.S. market and technology giants. The largest positions after the iShares Core S&P 500 at the end of September were the SPDR S&P 500 Trust (6.7%), Alphabet (2.5%), Microsoft (2.2%) and Salesforce (1.9%), GuruFocus notes.

This article was AI-translated and verified by a human editor