Stocks are in for another spurt before the bubble bursts, Dalio believes. What's his advice?

The Fed's easing of monetary policy in the absence of a crisis in the economy will further inflate the bubble, a legendary investor warns

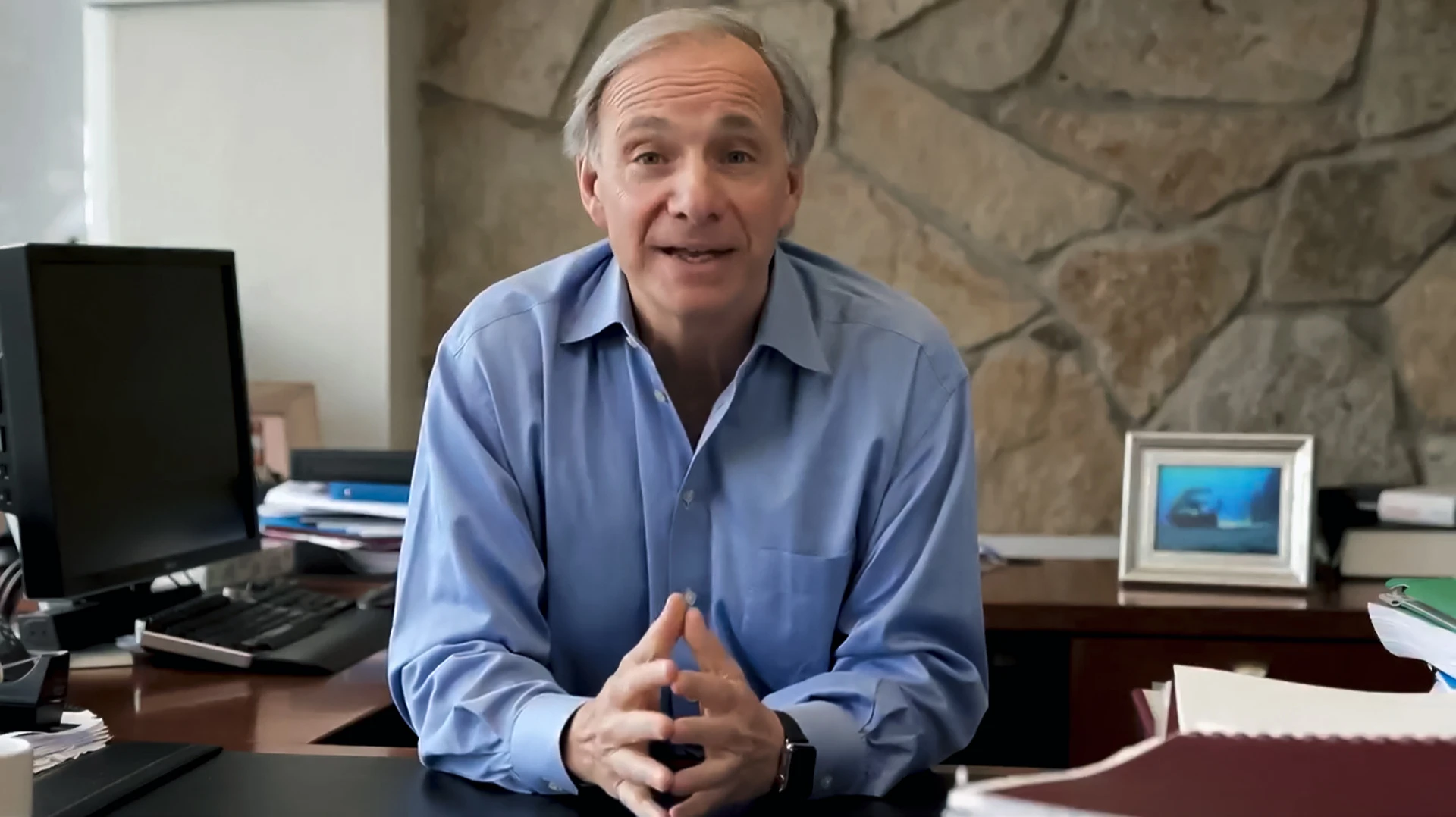

Ray Dalio, founder of the world's largest hedge fund Bridgewater Associates, has issued a warning to anyone waiting for the market rally to continue. In his post on the social network X, he wrote that the current policy of the Federal Reserve - lowering the rate and preparing for the transition from quantitative tightening to easing - may lead not to stabilization of the economy, but to more problems in the future. According to Dalio, the market is already overheated, and the influx of cheap money could inflate the bubble further before it bursts.

What does it mean to move to Fed policy easing

The Federal Reserve has cut rates twice this fall, to 3.75-4%, and since December it has stopped balance sheet reduction (so-called quantitative tightening, QT). This means that the Fed will no longer sell government bonds it owns, but will reinvest all funds received as part of their scheduled redemption, thus maintaining liquidity in the financial system.

Such actions in past cycles signaled a turn from restraining policy to stimulating growth in a weakening economy. But now, as Dalio notes, the economy is not in crisis, and stocks are trading at record multiples. That is, the Fed is actually keeping asset prices rising at a time when they are already expensive, the investor writes.

What's bothering Dalio.

Cheap money fuels buying, investors start to believe that "this time it will be different" and increase risk appetite. This is especially noticeable in the securities of AI companies, which, according to Dalio, are already in a bubble thanks to very lenient regulation of the sector and liberal fiscal and monetary conditions.

Dalio reminds us that this has all happened before: "It would be reasonable to expect that, as in late 1999 or 2010-2011, there would be a surge in liquidity, the risk level would rise significantly and it would have to be brought under control. During that surge and just before monetary policy tightening to curb inflation, which would lead to the bubble bursting, is usually the ideal time to sell."

What it means for investors

Dalio advises investors to watch the speed at which the Fed will increase the amount of assets on its balance sheet and cut rates amid the emerging bubble: "If the Fed's balance sheet starts to grow significantly while rates are falling and the budget deficit is large, we will see the classic interaction of monetary and fiscal policy - the actual monetization of government debt." If this happens at a time when inflation is above target, unemployment is near lows, the market is hitting highs, and the AI is in a bubble, "it will look like the Fed is stimulating the economy in a bubble," Dalio writes.

He notes that the Fed prefers market stability to aggressive inflation fighting ("especially in the current political environment"), so he does not urge investors to flee the market. But he advises to choose the right assets, taking into account the current specifics of monetary and fiscal policy in the United States.

"We should expect the Fed's intensified quantitative easing program to lower real interest rates and increase liquidity by compressing risk premiums, which in turn will lower real yields and increase P/E multiples, and, asset valuations in the technology, AI and growth equities sectors will rise," Dalio writes. - Assets that protect against rising prices, such as gold and inflation-indexed bonds, will also rise in price. Once inflation risk rises again, companies holding tangible assets - mining, infrastructure and real estate - are likely to perform better than pure technology companies.

This article was AI-translated and verified by a human editor