The dollar "survived" the Greenland scandal. But there are more risks for it

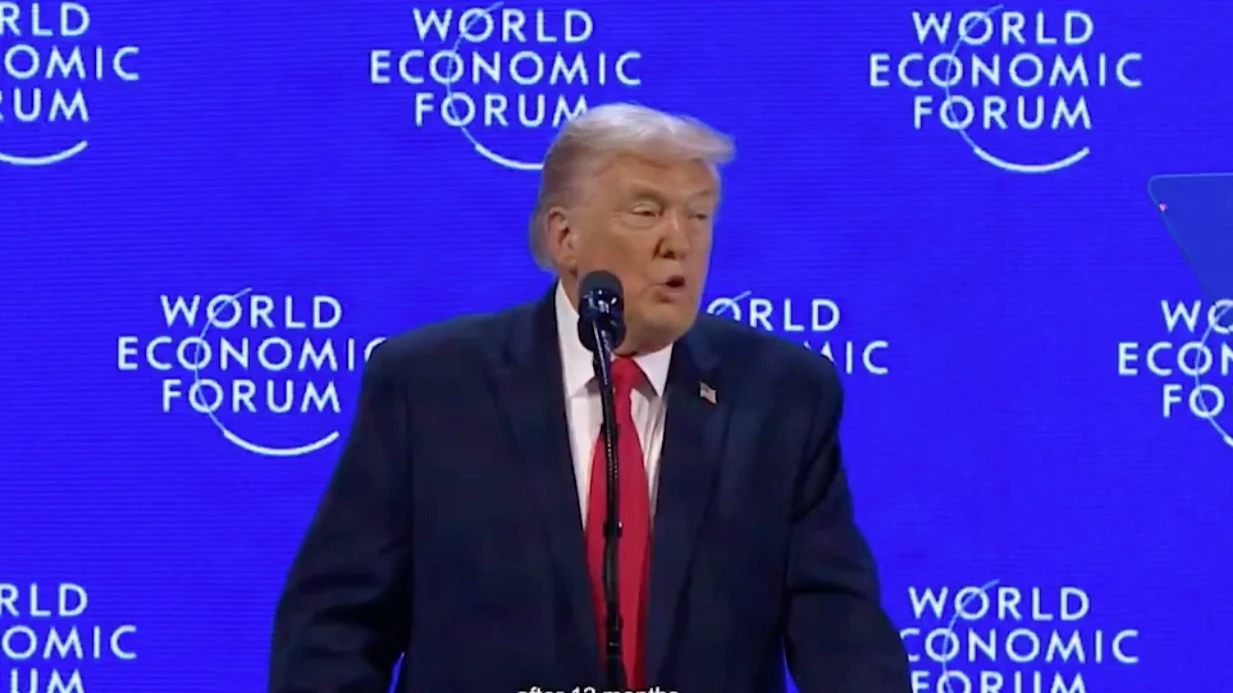

US President Donald Trump said at the Davos Economic Forum in Davos that the states are seeking immediate negotiations on the acquisition of Greenland. Photo: x / The White House

This year, US foreign policy changed course dramatically: instead of promises of "peace", US President Donald Trump started talking about taking over Greenland and threatening Europe with a new trade war. The dollar reacted to these threats, but weakly. Investors did not believe in the fulfillment of threats. But they should not relax, warns financier and member of the ACI Foreign Exchange Committee Sergey Romanchuk.

As 2026 began, U.S. President Donald Trump embarked on foreign policy with redoubled vigor, dramatically switching roles: from peacemaker, ending "more than eight wars," he took a sharp step toward foreign expansion: first taking on Venezuelan President Nicolas Maduro, and then declaring that he would "get Greenland" and, if he couldn't do it the easy way, he would do it the "hard way."

What seemed unthinkable earlier - annexation of the territory of a partner in the unified NATO military bloc - has suddenly become one of the declared scenarios of world politics. On January 17, Trump announced that eight European countries would receive additional duties of 10% on February 1 for opposing the sale of Greenland to the States, and that they would rise to 25% on June 1.

Predictably, this scandal led to a rise in the price of gold as a reserve asset and a fall in the dollar against a basket of currencies, primarily against the Swiss franc, but also against the euro. In the first half of the week, European stocks fell noticeably, as did American stocks - the market does not like uncertainty.

Yields on U.S. Treasuries, on the contrary, jumped sharply, but by mid-week (Wednesday evening, January 21) we can say that both bond market dynamics and currency fluctuations are still moderate. In terms of the US dollar index against a basket of major currencies (DXY), it lost less than 1%, and the yield on 10-year Treasury bonds has risen by about 3 basis points since the beginning of the week.

What it means. Despite the harsh reciprocal rhetoric from U.S. and European politicians and Trump's demonstrative confidence in the success of his venture, markets did not believe in the realization of the threats and the possibility that the U.S. would annex Greenland.

This was directly seen in the quotes on Polymarket, where bets on Trump annexing Greenland by 2027 did not exceed 20%. This is far from zero, but they are not so high that the bulk of investors proceed from the realization of this scenario.

Traders have learned from the experience of "liberation day" on April 2, 2025. At that time Trump declared a trade war with several dozen countries, which implied higher duties on imports to the U.S., but the deadlines for the entry into force of these decisions were postponed, and in the end the U.S. concluded trade agreements with most trading partners. Now the market was expecting a similar TACO (Trump Always Chicken Out) effect: the U.S. President would again "backtrack" at some point.

That's just how it turned out. Speaking at the Davos forum, Trump had already said that the states would not use "excessive force" to acquire Greenland. And then he wrote in Truth Social that he would not impose trade duties on imports from countries that opposed the sale of Greenland to the states.

Why the market didn't believe Trump

Trump's adventures are looking more and more like throwing around looking for a hot topic for PR rather than a thoughtful strategy.

Shifting the attention of voters to the topic of Greenland annexation, based on attempts to raise his rating (and his activity as president is approved by only 41% of Americans) is not very profitable for him: the vast majority of U.S. citizens are against efforts to acquire Greenland (17% approve, 47% do not approve, 35% are not sure, only 4% support the idea of a military takeover).

Stubbornness on the issue of Greenland annexation due to the unpopularity of this step will only increase the chances of defeating the Republicans in the November elections to the U.S. Congress. And a convincing Democratic victory will once again make Congress capable of blocking the president's exotic decisions.

The reasons Trump has given for "justifying" the annexation of Greenland are completely artificial. He has repeatedly stated that the territory "could be taken" by Russia or China. But as a NATO member, the U.S. not only has the right but the obligation to defend Greenland from anyone. Mining minerals on the island is unprofitable. But in the future, U.S. and European companies may be allowed to mine minerals there, which can be fixed through separate agreements. This is contained in the de-escalation plan proposed by former Danish Prime Minister Anders Fogh Rasmussen (aka former NATO Secretary General).

So it would be easy enough for Trump to abandon the idea of annexing Greenland, just change his mind and make a "good deal" by signing the annexes to the 1951 US-Danish Defense of Greenland treaty. Under it, the states can place and operate military bases on the island.

What is important for investors to keep in mind

But no matter how Ma the likelihood of annexation of Greenland, 85% of whose population is opposed to joining the US, according to a January 2025 poll, the political and economic consequences of a crisis in US-EU relations could be significant.

What do we have now? The status of the dollar as the world's reserve currency and "safe haven" has once again suffered a blow. Already now the Danish pension fund AkademikerPension has announced that by the end of January it will sell about $100 million worth of U.S. government bonds it owns. The official reason given is the "weak state of U.S. public finances," which forces the fund to seek "alternative liquidity and risk management" (in the paraphrase of Reuters).

In essence, it is about the fact that US President Donald Trump has created credit risks that cannot be ignored. Indeed, no matter how unrealistic a military confrontation between the US and Europe may seem, moving up the escalation ladder may bring other surprises. For example, measures to restrict capital flows, even if they seem unthinkable at the moment.

Generally speaking, the economies and finances of the EU and the US are so intertwined that severing relations would look impossible for either side.

The mutual losses could be great, and no estimate of the "profitability" of a Greenland takeover would come even close to recouping the possible damage.

The entire US economy is built on the ability to borrow externally, Trump is going to increase the military budget by 50% next year, to $1.5 trillion, with counterparties in Europe owning about $2 trillion in US Treasuries out of about $30 trillion in outstanding bonds.

A sharp reset of at least some of these securities, along with losses for their holders, would lead to a sharp rise in the cost of new borrowing for the U.S. budget and could lead to a full-blown financial crisis. We saw something similar last Ma, when a sharp rise in U.S. bond yields forced Treasury Secretary Scott Bessent to urgently reassure investors and ultimately made Trump much more accommodating on the terms of international trade.

The increase in duties on European goods itself would not only threaten Europe, but also the US itself - US importers and consumers would pay the tariffs. According to a Kiel Institute research paper, although the U.S. government intended the duties to hit foreign companies, the policy actually hurts the domestic economy. Import prices have risen by almost the full amount of the duties, while foreign exporters have not lowered their prices. This means that U.S. buyers are paying almost the entire tariff (96% to be exact).

Risks for the dollar

The trend of dollar weakening from my point of view has all chances to continue, as long as the American policy does not undergo another sharp reversal.

But it's important to note that political instability is just one of the factors affecting the financial market and exchange rates.

The powerful narrative of growth in the value of US major companies on the wave of AI technology development has supported investments in the stock market and attracted foreign investors. The dollar's relevance depends on the continuation of this growth. In other words, if the market grows, investors will buy the U.S. currency, turning a blind eye to politics.

Other factors - the structural adjustment of the US economy, the issue of Fed independence, inflation and the trajectory of the interest rate - do not depend solely on the state of European-US relations and will determine the exchange rate.

Also important is what is happening in other countries with freely convertible currencies: a sharp rise in interest rates in Japan and the possibility of large-scale currency intervention could also strengthen the yen and weaken the dollar after the acute phase of the debt crisis has passed and rates have stabilized.

The risks of owning the dollar are obviously growing, and diversification, mainly in the form of limiting new investments in the US market, especially by sovereign wealth funds, will increase. But the lack of a comparable alternative financial market to the U.S. makes this process relatively smooth.

This article was AI-translated and verified by a human editor