The price of bias: how cognitive distortions drive investment against logic

Cognitive distortion blocks the ability to objectively analyze probabilities and replaces estimates with possible-impossible.

The share of equities in investors' portfolios has reached a record level since the end of 2024, so optimistic investors have not been for the past five years, a February survey of global fund managers conducted by Bank of America showed. Meanwhile, the amount of cash held in mutual fund portfolios is unusually low at just 3.4%. This bias in favor of riskier assets is dangerous, writes Barron's. Over the past few years, stocks have been growing, and perhaps the desire to invest in them now is a consequence of cognitive distortions, psychologist Mikhail Tegin does not rule out. In his column for Oninvest, he discusses how this makes us act against logic and to the detriment of our investment portfolio.

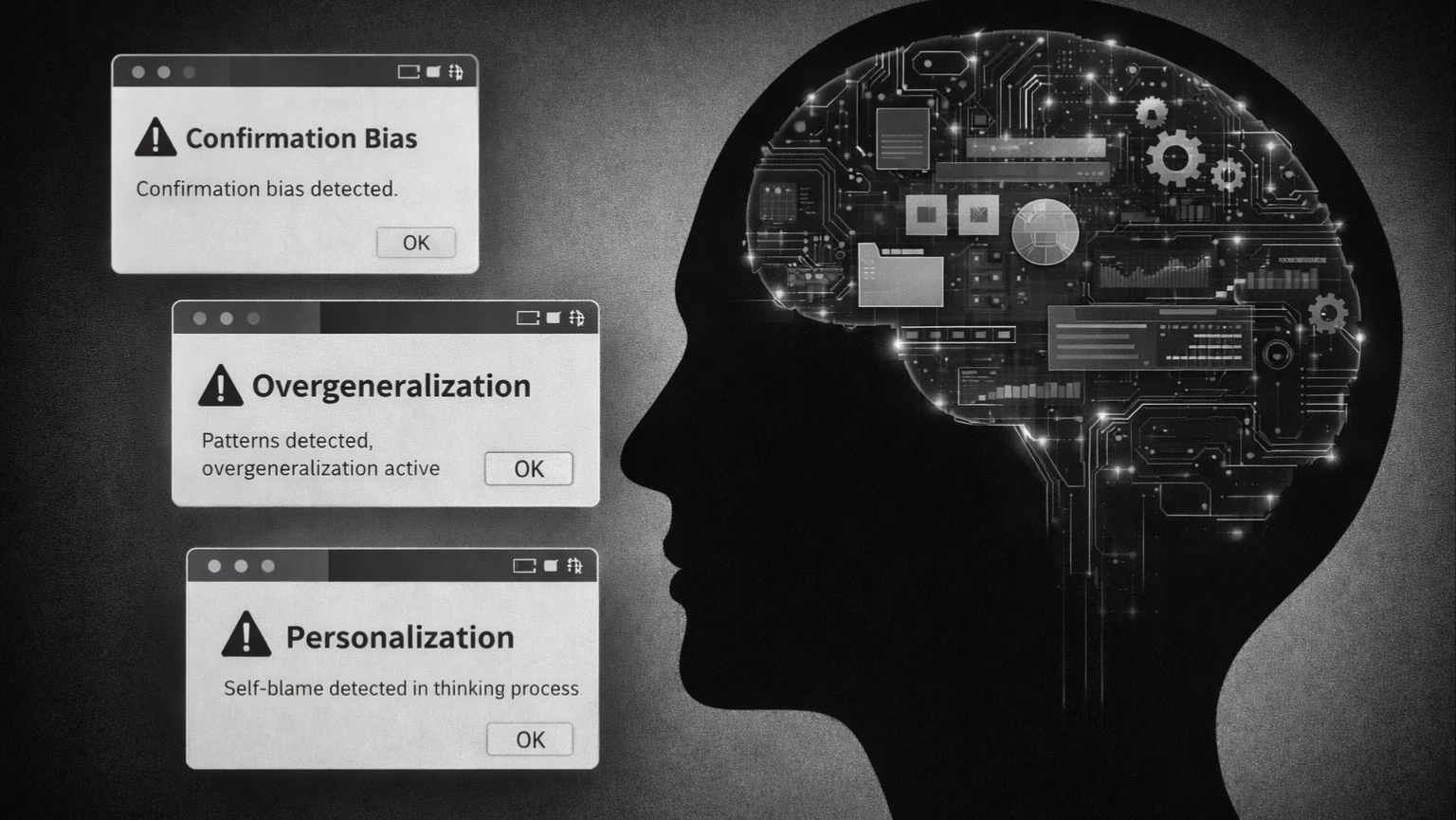

The operating system of consciousness: what causes failures

Cognitive functions are a kind of operating system of our mind, the processes by which we take in, process and store information: perception, attention, memory, thinking and intelligence.

When any cognitive function, or several of them at once, try to conserve resource or protect the psyche from stress, cognitive distortions occur. The brain quickly reads information from the human environment and from within (emotions, fantasies) and very quickly realizes that deep analysis (thinking function) in a particular situation may require too much energy. And then the brain slips us a pre-prepared template of reasoning, assumptions or conclusions. These templates are distortions - systematic bias in thinking. And in this sense they are very close in their essence and function to stereotypes, because it is a stable, simplified and pre-formed image or belief about objects, phenomena or people.

Breaking down the most dangerous cognitive distortions.

Debt or why resentment is unconstructive

One of the most destructive traps are imperatives. They sound like axioms in an investor's mind: "The market should have reversed at this support level" or "I must make 5% return per month to be considered a pro".

When reality doesn't match our "shoulds," cognitive dissonance occurs, followed immediately by emotions. Usually anger or resentment. Instead of locking in a loss when the price breaks a certain level, the investor freezes in a pose of "offended dignity", waiting for the market to "come to its senses".

Cognitive psychologists emphasize that anxiety and anger often grow or rather arise in response to our own rigid demands on external reality, but there is also an internal reality - our feelings, thoughts, fantasies, desires and so on. In the stock market, this is a direct way to "accumulate" losses.

Overgeneralization: a single error as a sentence

This distortion makes us draw global conclusions based on a single case. You went into options or cryptocurrency once unsuccessfully, lost money and now you think: that it is a scam and it is impossible to make money there. In the movie "The Wolf of Wall Street" the characters often use the mechanism of overgeneralization to convince clients that "this sector is always growing".

Overgeneralization is characterized by extremes: if you notice words like "impossible" "never" "never" "no way" "no one" "always" and similar extremes in your thoughts, you have a cognitive distortion at work. It deprives us of flexibility because it blocks our ability to objectively analyze probabilities and replaces evaluations with possible-impossible.

Personalization: you are your portfolio

This is the tendency to take things personally. In the market, it can manifest itself in the belief that price movements are personally directed against you. For example: "As soon as I buy, the price goes down".

This leads to labeling: instead of realistically assessing the situation and perhaps admitting a calculation error, we tell ourselves "I'm a loser" or "I'm a bad investor."

This happens because we identify ourselves with our trade, with our failure, and as a result we lose the ability to close it with a minimum of losses - financial and emotional. For an investor, closing a losing position under the influence of personalization means admitting that he or she is "defective". And that's unpleasant and not something you want to do.

Selective abstraction: 'redness' in the eye of the beholder

This distortion turns investing into torture. Why it happens: Out of the entire data set, your brain picks out one single detail that confirms your fears - it's called confirmation bias. You focus on it so that this detail doesn't become the very factor that will lead to disaster. And because your brain needs to avoid it at all costs, you end up even devaluing your own good decisions, seeing them as luck and mistakes as legitimate evidence of incompetence. All this increases the level of the stress hormone cortisol and leads to emotional burnout.

How to fix the "crooked mirrors" of biased thinking

To deal with distortions, we first need to do a cognitive audit - that is, to understand what we are actually dealing with. Run your thought through three test questions with yourself before you make a decision and act on it:

Is it a fact or a feeling? This is how we try to see if "emotional reasoning" - the principle that you take your feelings as irrefutable evidence of truth - is working in us right now. That is, "If I feel this way, it must be so."

Am I seeing the whole picture or do I have some blind spots? This is how we check to see if selective abstraction has kicked in.

What would I advise a friend in this situation? This technique is called distancing - we can look at the situation not as for ourselves, but as for the respected other. In this technique the mechanism of projection works - we consciously transfer the problem to the figure of another person, returning the ability to see the context and the whole picture, not just from the point of "I".

Once you learn to recognize your distortions, they lose some of their power over you - it's like looking fear in the eye.

This article was AI-translated and verified by a human editor